In the digital age, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. In the case of educational materials such as creative projects or just adding some personal flair to your space, Is A Personal Trainer Tax Deductible In Canada have become a valuable resource. This article will dive deeper into "Is A Personal Trainer Tax Deductible In Canada," exploring what they are, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Is A Personal Trainer Tax Deductible In Canada Below

Is A Personal Trainer Tax Deductible In Canada

Is A Personal Trainer Tax Deductible In Canada - Is A Personal Trainer Tax Deductible In Canada, Is Personal Training Tax Deductible In Canada, Is A Personal Trainer Tax Deductible, Can You Claim Personal Training On Your Taxes Canada, Can I Deduct Personal Trainer Expenses

Review all deductions credits and expenses you may claim when completing your tax return to reduce your tax owed Claim amounts for your children eligible dependants and spouse or

In general for an expense to be tax deductible in Canada it must be directly related to earning income and not a personal expense Most personal expenses such as gym memberships are not directly linked to earning

Is A Personal Trainer Tax Deductible In Canada provide a diverse collection of printable items that are available online at no cost. These printables come in different types, like worksheets, templates, coloring pages and many more. The attraction of printables that are free is their versatility and accessibility.

More of Is A Personal Trainer Tax Deductible In Canada

Home Care Tax Deductions In Canada A Comprehensive Guide The

Home Care Tax Deductions In Canada A Comprehensive Guide The

103 rowsFind out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay

Gym memberships can be deducted as business expenses on your personal tax return if you work for yourself If you need to keep receipts keep them so that the Canada Revenue Agency can review your claim The

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: You can tailor designs to suit your personal needs, whether it's designing invitations, organizing your schedule, or decorating your home.

-

Educational Use: The free educational worksheets cater to learners of all ages. This makes them a useful tool for parents and educators.

-

Easy to use: Quick access to various designs and templates will save you time and effort.

Where to Find more Is A Personal Trainer Tax Deductible In Canada

Are Home Renovations Tax Deductible In Canada RooHome

Are Home Renovations Tax Deductible In Canada RooHome

How to consider training expenses for the Canada Training Credit including a refundable tax credit of 50 of tuition fees how to claim and file Learn about CTC Canada Training Credit how to ensure your training is tax

Hodson proposes the federal government allow Canadians to claim their gym membership fees as a medical expense on their personal income tax returns and the

After we've peaked your interest in Is A Personal Trainer Tax Deductible In Canada Let's look into where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Is A Personal Trainer Tax Deductible In Canada designed for a variety motives.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a wide range of interests, starting from DIY projects to party planning.

Maximizing Is A Personal Trainer Tax Deductible In Canada

Here are some innovative ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is A Personal Trainer Tax Deductible In Canada are an abundance of practical and innovative resources that can meet the needs of a variety of people and desires. Their accessibility and flexibility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast world of Is A Personal Trainer Tax Deductible In Canada right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can print and download these documents for free.

-

Can I use free printables for commercial use?

- It's all dependent on the rules of usage. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright concerns with Is A Personal Trainer Tax Deductible In Canada?

- Certain printables might have limitations in their usage. Make sure to read the terms and conditions provided by the creator.

-

How can I print Is A Personal Trainer Tax Deductible In Canada?

- You can print them at home using either a printer at home or in a print shop in your area for high-quality prints.

-

What software do I need to open printables for free?

- The majority are printed in the PDF format, and can be opened with free software such as Adobe Reader.

Is Medical Cannabis Tax deductible In Canada We Have The Answer Leafly

Tax Deductions For BetterHelp In Canada What You Need To Know 2024

Check more sample of Is A Personal Trainer Tax Deductible In Canada below

Is Home Insurance Tax Deductible In Canada Surex

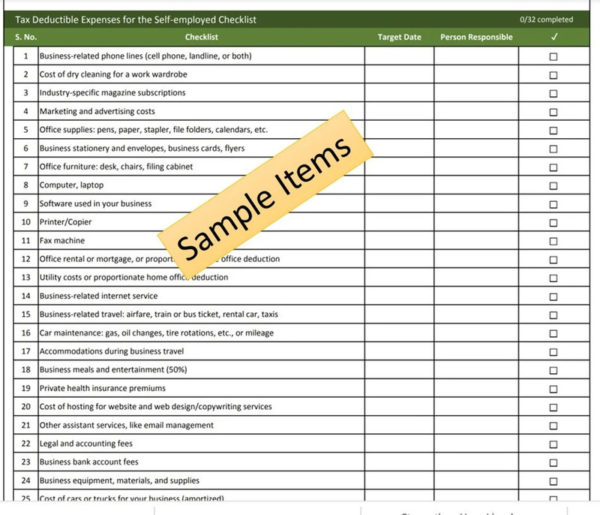

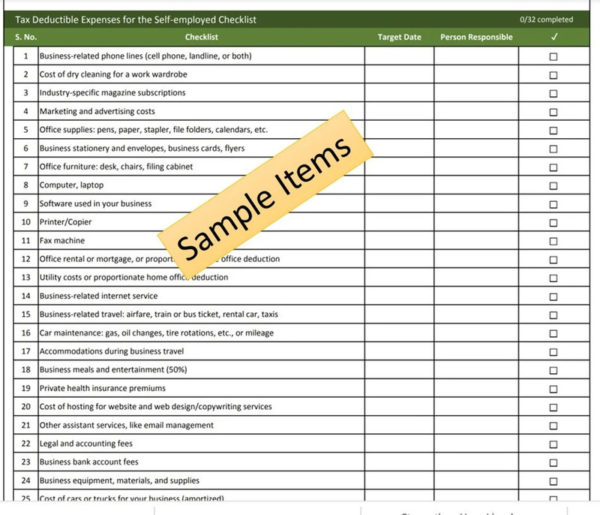

Tax Deductible Expenses For The Self employed Checklist

Income Tax Worksheet Templates

Investment Expenses What s Tax Deductible 2024

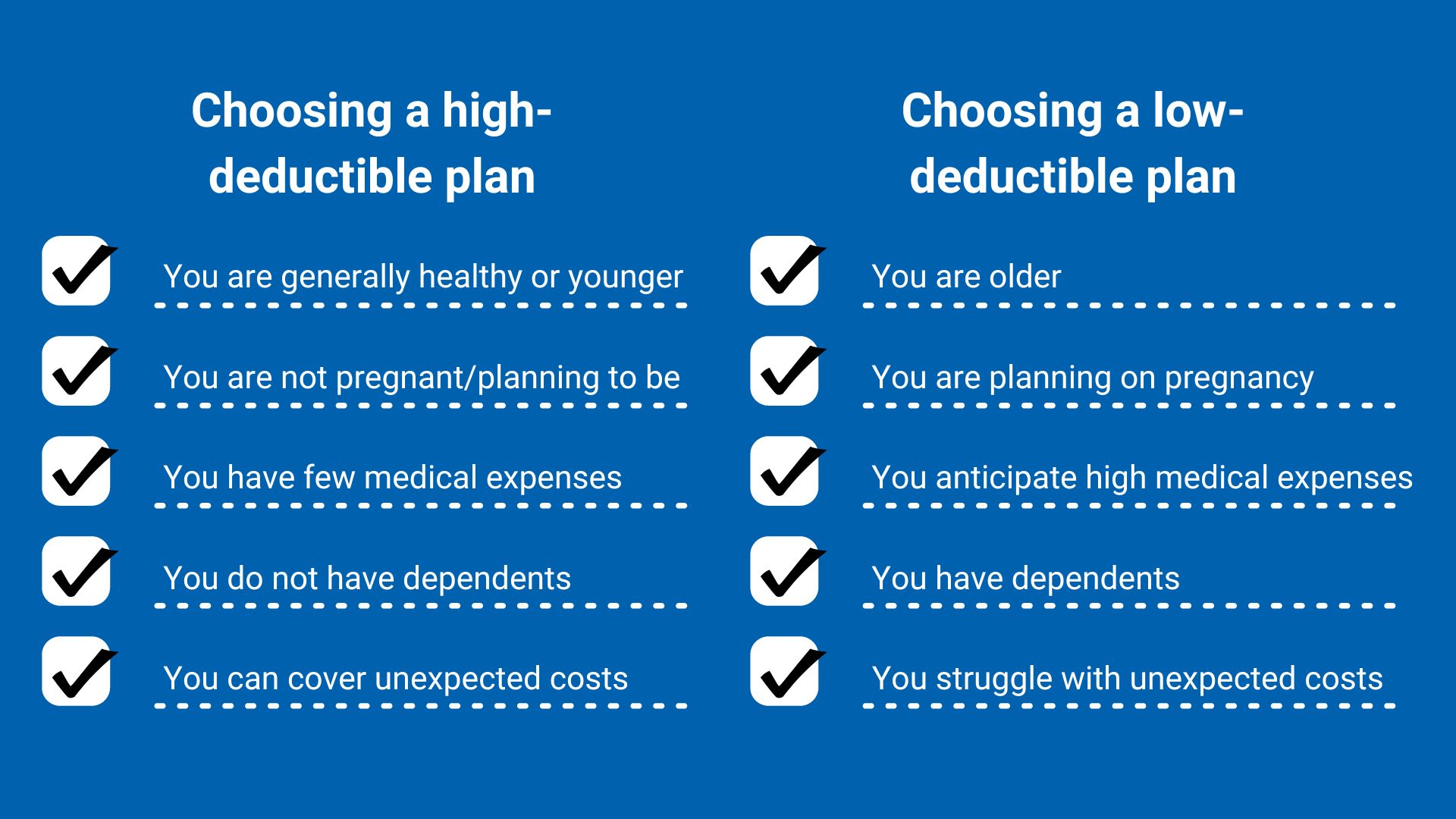

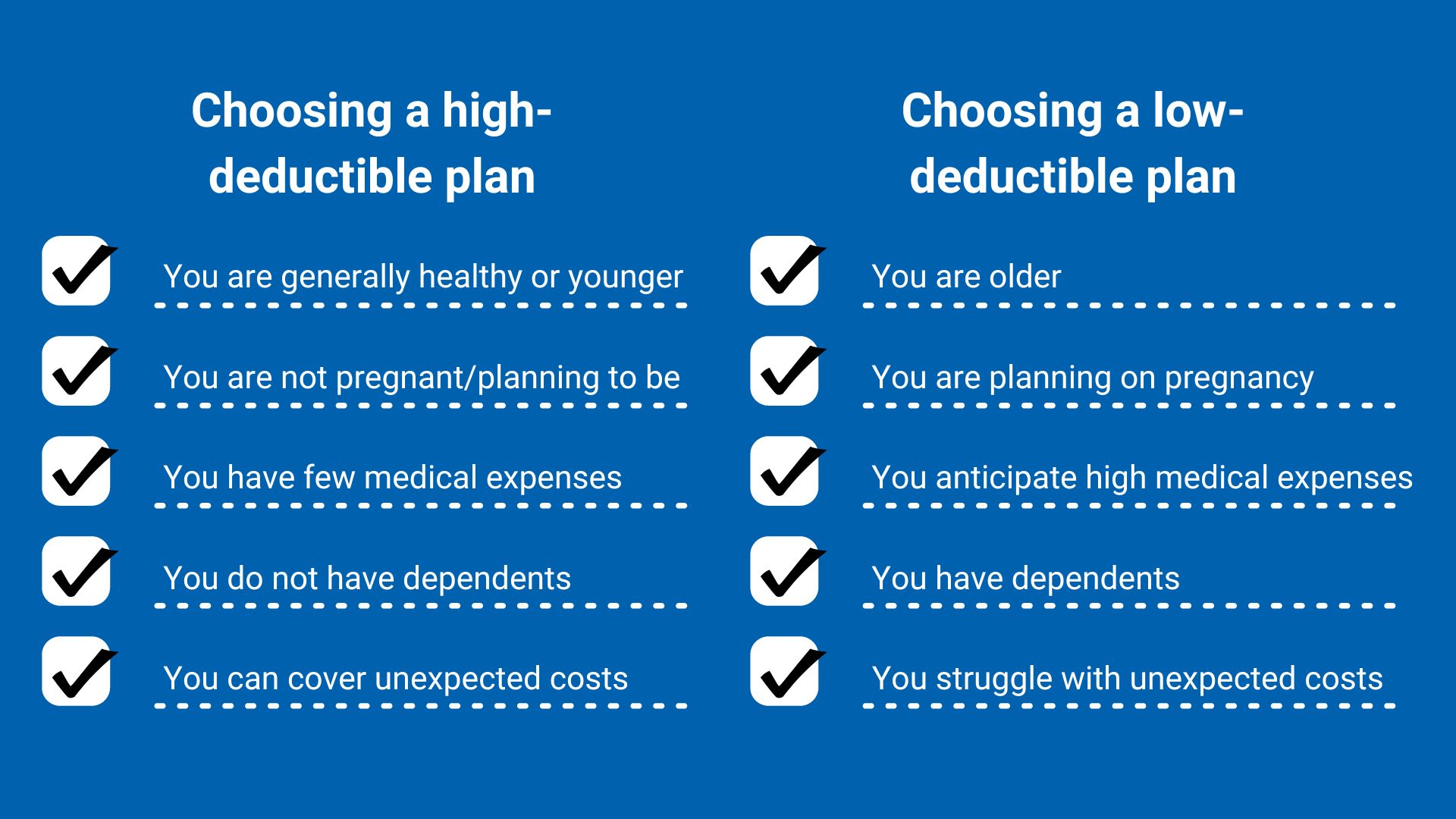

What Are Deductibles Blue Ridge Risk Partners

Personal Trainer Vs Self Led Gym Why The Choice Is Clear

https://raisetbar.com › are-gym-membership…

In general for an expense to be tax deductible in Canada it must be directly related to earning income and not a personal expense Most personal expenses such as gym memberships are not directly linked to earning

https://fitness-n-health.com › are-personal-training...

The Canada Revenue Agency CRA allows taxpayers to deduct costs incurred for training courses and personal trainer certification even at the start of their career

In general for an expense to be tax deductible in Canada it must be directly related to earning income and not a personal expense Most personal expenses such as gym memberships are not directly linked to earning

The Canada Revenue Agency CRA allows taxpayers to deduct costs incurred for training courses and personal trainer certification even at the start of their career

Investment Expenses What s Tax Deductible 2024

Tax Deductible Expenses For The Self employed Checklist

What Are Deductibles Blue Ridge Risk Partners

Personal Trainer Vs Self Led Gym Why The Choice Is Clear

Everything You Need To Know About Health Insurance

Is A Personal Trainer Worth It You Decide Fitness Report

Is A Personal Trainer Worth It You Decide Fitness Report

Can You Deduct Unreimbursed Employee Expenses In 2022