In the age of digital, in which screens are the norm yet the appeal of tangible printed objects hasn't waned. Be it for educational use and creative work, or just adding some personal flair to your home, printables for free are now a vital resource. In this article, we'll take a dive into the world of "Can I Deduct Personal Trainer Expenses," exploring what they are, where to locate them, and ways they can help you improve many aspects of your lives.

Get Latest Can I Deduct Personal Trainer Expenses Below

Can I Deduct Personal Trainer Expenses

Can I Deduct Personal Trainer Expenses - Can I Deduct Personal Trainer Expenses, Can You Deduct Personal Trainer Expenses On Taxes, Can I Write Off A Personal Trainer, Is A Personal Trainer Tax Deductible

Explore this guide to personal trainer tax deductions and ensure you get the tax savings you re eligible for Can I Deduct Personal Trainer Expenses You can deduct business expenses from your taxable income as a

If you re a coach or a personal trainer you can take advantage of a few tax deductions this tax season despite some rule changes from tax reform Prior to the 2018 tax reform unreimbursed job

Can I Deduct Personal Trainer Expenses provide a diverse variety of printable, downloadable documents that can be downloaded online at no cost. They come in many designs, including worksheets coloring pages, templates and much more. The great thing about Can I Deduct Personal Trainer Expenses lies in their versatility as well as accessibility.

More of Can I Deduct Personal Trainer Expenses

Can I Deduct Personal Trainer Expenses At George Sanchez Blog

Can I Deduct Personal Trainer Expenses At George Sanchez Blog

Those wondering can I deduct personal trainer tax expenses from legal and financial fees should reference the following list of acceptable cases The hiring of accountants solicitors surveyors

Can Personal Trainers Claim For Gym Membership Fees If you re self employed and provide professional personal training services at a gym it can be claimed as an allowable expense providing you don t

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization You can tailor the design to meet your needs, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Educational value: Printing educational materials for no cost are designed to appeal to students of all ages. This makes the perfect source for educators and parents.

-

Easy to use: instant access a variety of designs and templates, which saves time as well as effort.

Where to Find more Can I Deduct Personal Trainer Expenses

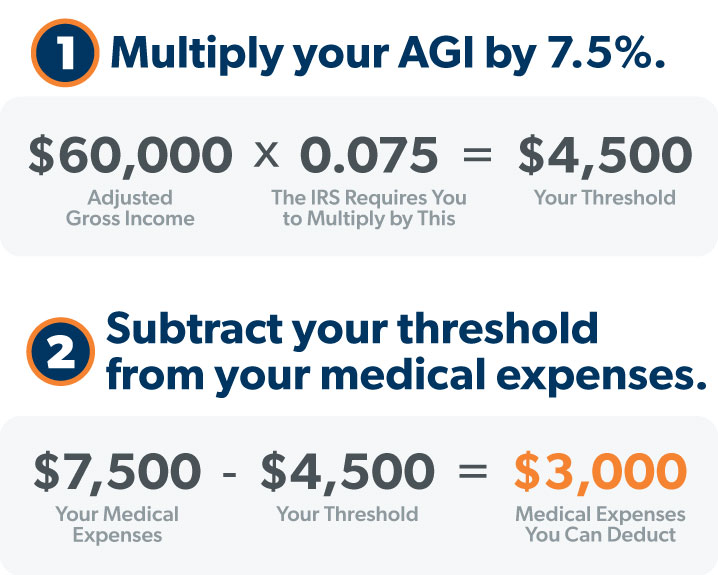

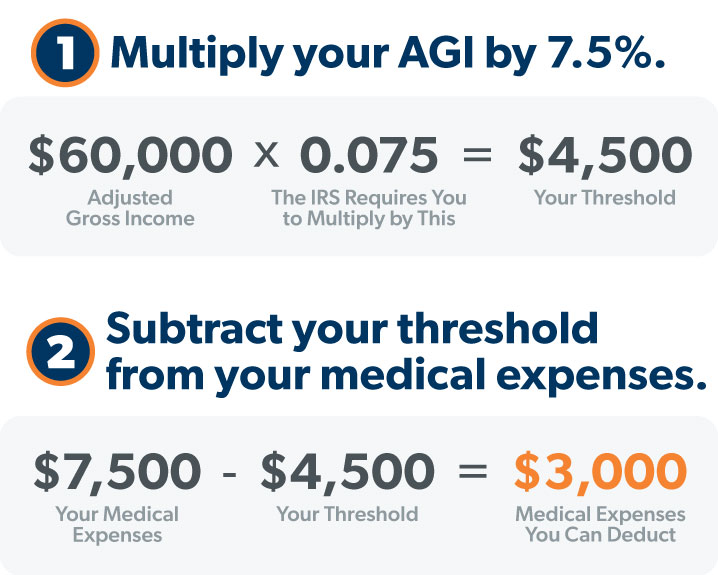

Can I Deduct Medical Expenses On My Tax Return SKP Accountants

Can I Deduct Medical Expenses On My Tax Return SKP Accountants

Discover top tax deductions for personal trainers to maximize your savings Our expert guide explains eligible expenses and tips to file your taxes with ease Learn more about the most common

As a self employed personal trainer HMRC lets you deduct your business expenses from your overall income when you do your tax return This means that you only pay tax on your profits If you re not self

If we've already piqued your interest in Can I Deduct Personal Trainer Expenses Let's see where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and Can I Deduct Personal Trainer Expenses for a variety objectives.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs are a vast selection of subjects, everything from DIY projects to party planning.

Maximizing Can I Deduct Personal Trainer Expenses

Here are some unique ways for you to get the best use of Can I Deduct Personal Trainer Expenses:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Can I Deduct Personal Trainer Expenses are a treasure trove of practical and imaginative resources which cater to a wide range of needs and hobbies. Their accessibility and versatility make them a great addition to both professional and personal life. Explore the many options of Can I Deduct Personal Trainer Expenses today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can print and download the resources for free.

-

Can I use the free printables for commercial purposes?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables could have limitations in use. Be sure to review these terms and conditions as set out by the author.

-

How can I print Can I Deduct Personal Trainer Expenses?

- You can print them at home with either a printer at home or in the local print shop for better quality prints.

-

What software is required to open Can I Deduct Personal Trainer Expenses?

- Most printables come as PDF files, which can be opened using free software, such as Adobe Reader.

Can I Deduct Personal Trainer Expenses At George Sanchez Blog

Can You Deduct Remodeling Expenses For Your Rental Property

Check more sample of Can I Deduct Personal Trainer Expenses below

What Medical Expenses Can I Deduct A Look At Tax Deductions

Can I Deduct Insurance Premiums

Can You Deduct Property Taxes With A Standard Deduction

Can I Deduct Personal Taxes That I Pay As An Itemized Deduction On

Preparing House For Sale Tax Deduction How To Get Benefits Tax

Can I Deduct Mortgages For 3 Houses On My Tax Returns

https://turbotax.intuit.com › tax-tips › s…

If you re a coach or a personal trainer you can take advantage of a few tax deductions this tax season despite some rule changes from tax reform Prior to the 2018 tax reform unreimbursed job

https://www.keepertax.com › tax-write-offs › personal-trainer

As a freelance personal trainer you can put your ordinary expenses from kettlebells to gym memberships to work Think of it as sweating out savings from your tax bill

If you re a coach or a personal trainer you can take advantage of a few tax deductions this tax season despite some rule changes from tax reform Prior to the 2018 tax reform unreimbursed job

As a freelance personal trainer you can put your ordinary expenses from kettlebells to gym memberships to work Think of it as sweating out savings from your tax bill

Can I Deduct Personal Taxes That I Pay As An Itemized Deduction On

Can I Deduct Insurance Premiums

Preparing House For Sale Tax Deduction How To Get Benefits Tax

Can I Deduct Mortgages For 3 Houses On My Tax Returns

What Expenses Can You Deduct Accounting Firms

How To Deduct Meals And Entertainment In 2023 Bench Accounting

How To Deduct Meals And Entertainment In 2023 Bench Accounting

Claim Medical Expenses On Your Taxes Health For CA