In the age of digital, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. Be it for educational use as well as creative projects or simply to add an individual touch to your area, How To Compute Bir Quarterly Percentage Tax can be an excellent resource. This article will dive into the sphere of "How To Compute Bir Quarterly Percentage Tax," exploring the benefits of them, where to find them, and what they can do to improve different aspects of your lives.

What Are How To Compute Bir Quarterly Percentage Tax?

How To Compute Bir Quarterly Percentage Tax provide a diverse assortment of printable, downloadable documents that can be downloaded online at no cost. These materials come in a variety of forms, like worksheets templates, coloring pages, and much more. One of the advantages of How To Compute Bir Quarterly Percentage Tax is their versatility and accessibility.

How To Compute Bir Quarterly Percentage Tax

How To Compute Bir Quarterly Percentage Tax

How To Compute Bir Quarterly Percentage Tax - How To Compute Bir Quarterly Percentage Tax, How To Compute Quarterly Percentage Tax Bir Form, How To File Bir Quarterly Percentage Tax Online, How To Compute Bir Percentage Tax, How To Compute Quarterly Percentage Tax, How To Compute Percentage Tax

[desc-5]

[desc-1]

BIR UPDATE Filing BIR Form 2551Q Under PERCENTAGE TAX RATE Of 3

BIR UPDATE Filing BIR Form 2551Q Under PERCENTAGE TAX RATE Of 3

[desc-4]

[desc-6]

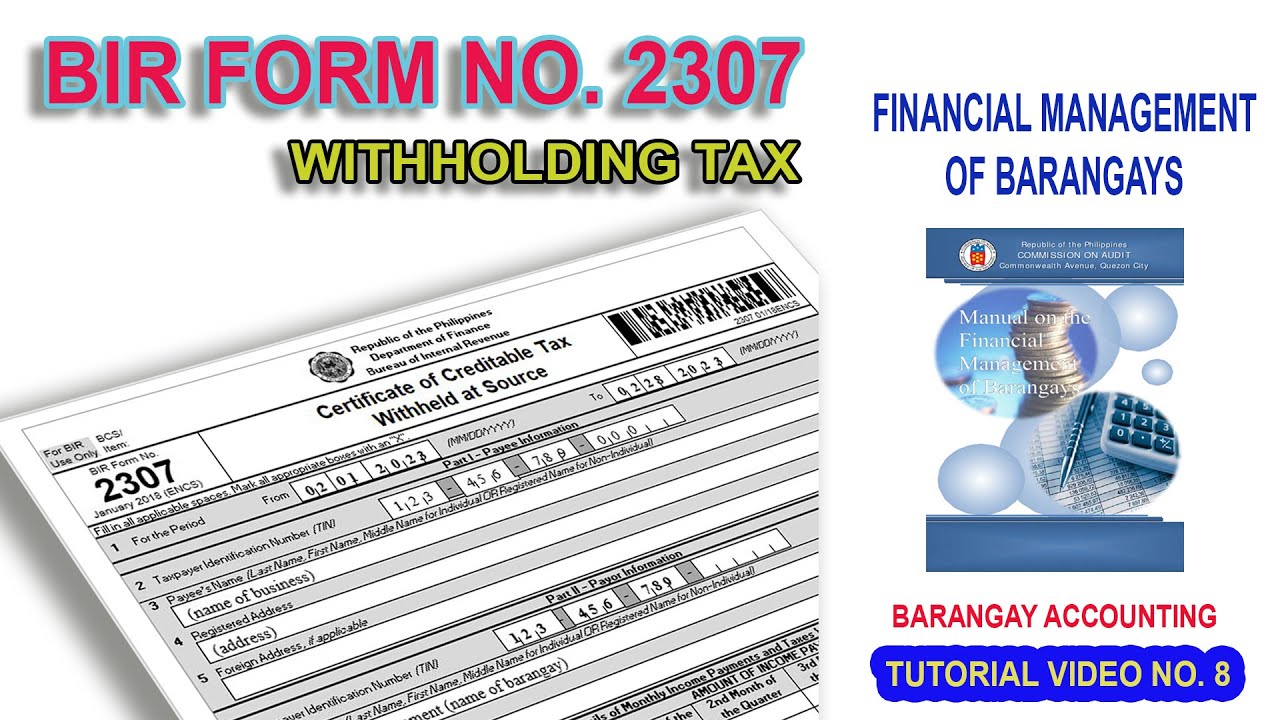

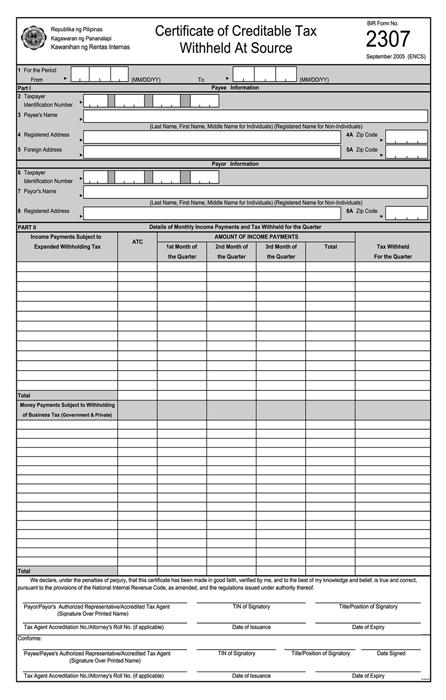

Form 2307

Form 2307

[desc-9]

[desc-7]

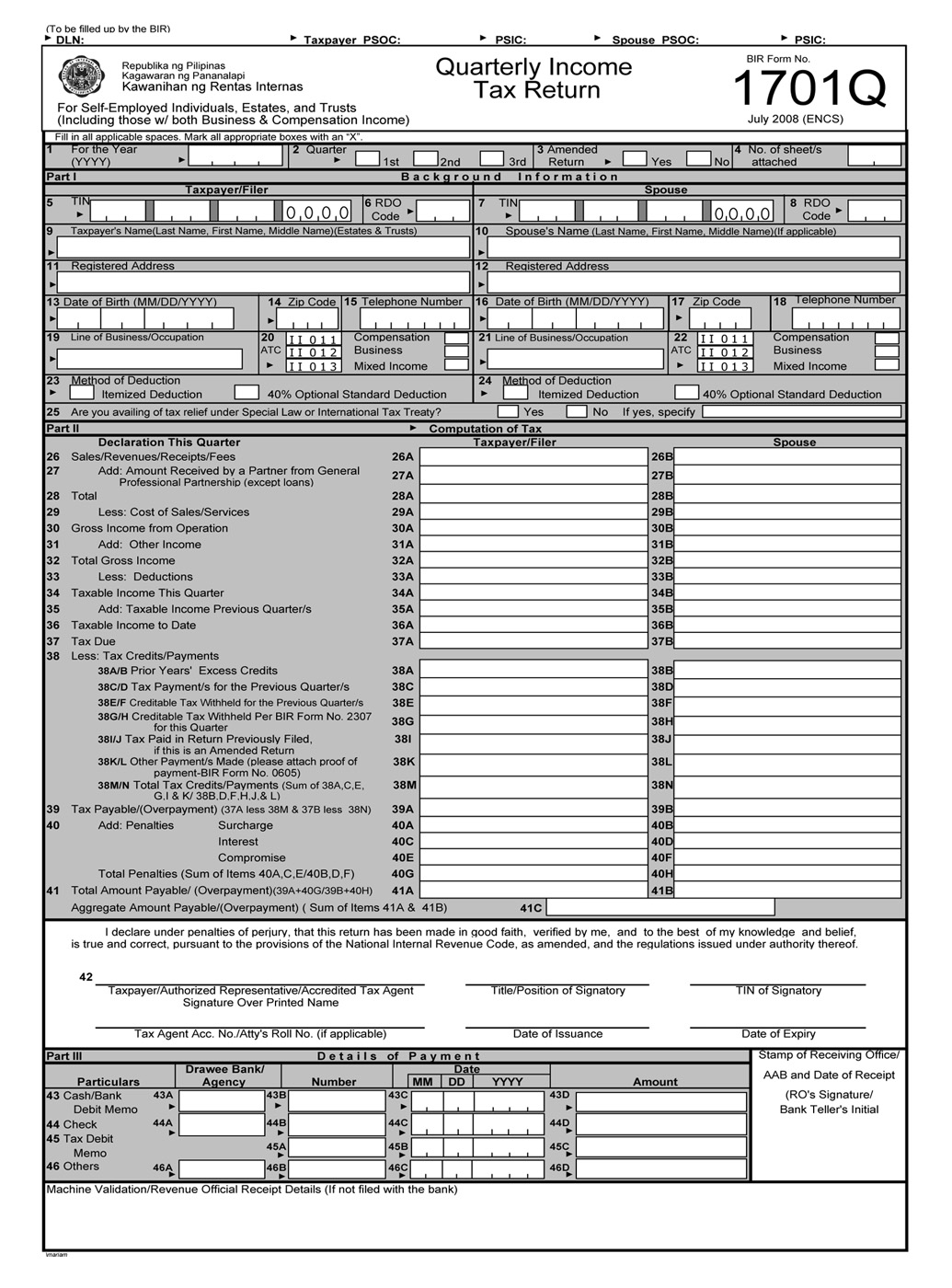

BIR form 1701Q 1st Quarter Kaila Sharlene

Individual Income Tax Rates 2024 Philippines Image To U

BIR Form 1904 A Comprehesive Guide TAXGURO

Deadline Of 1702q 2025 Christopher C Rosa

Busapcom BIR Form No 1701Q

2025 Est Tax Dates Enola Willow

2025 Est Tax Dates Enola Willow

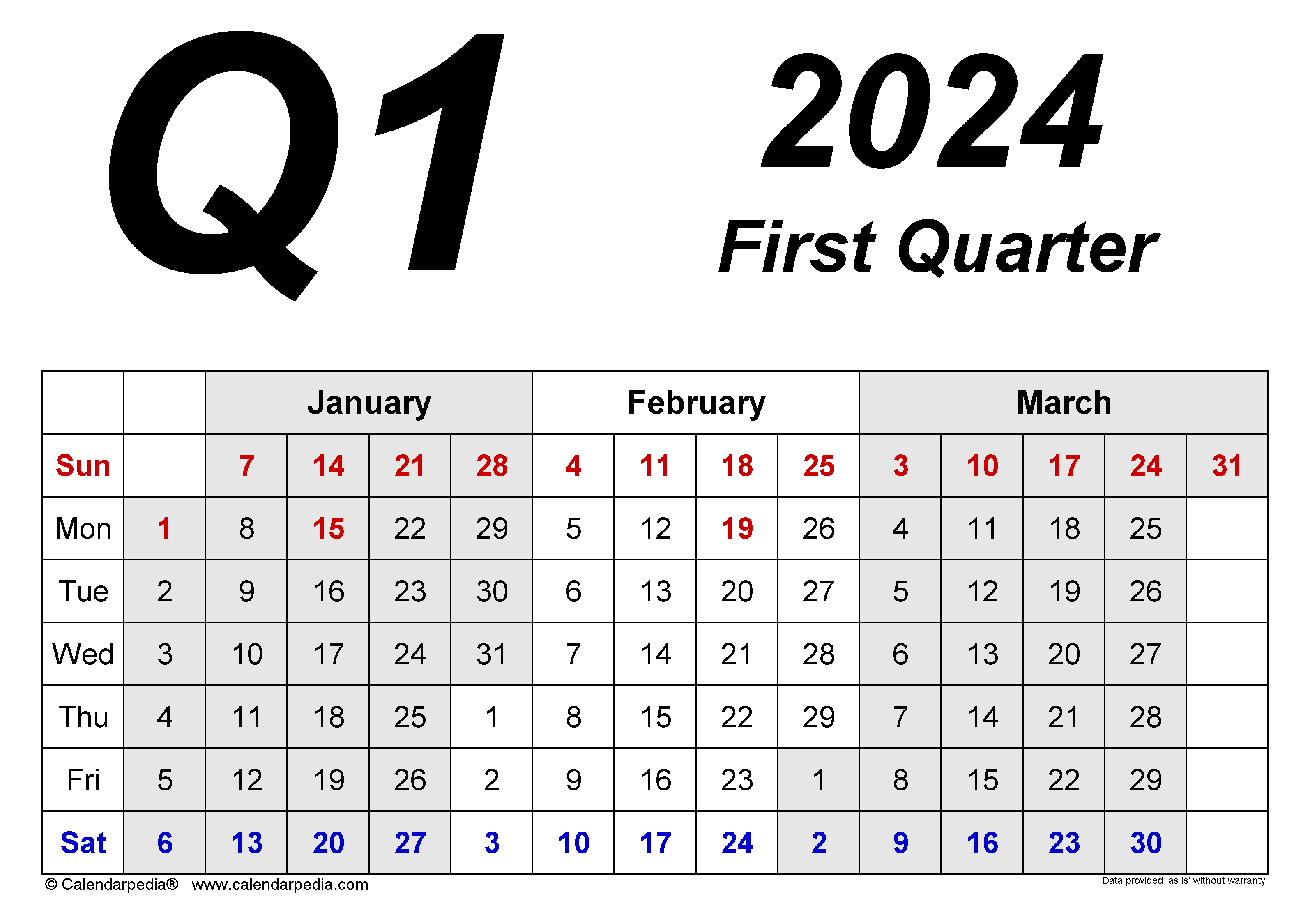

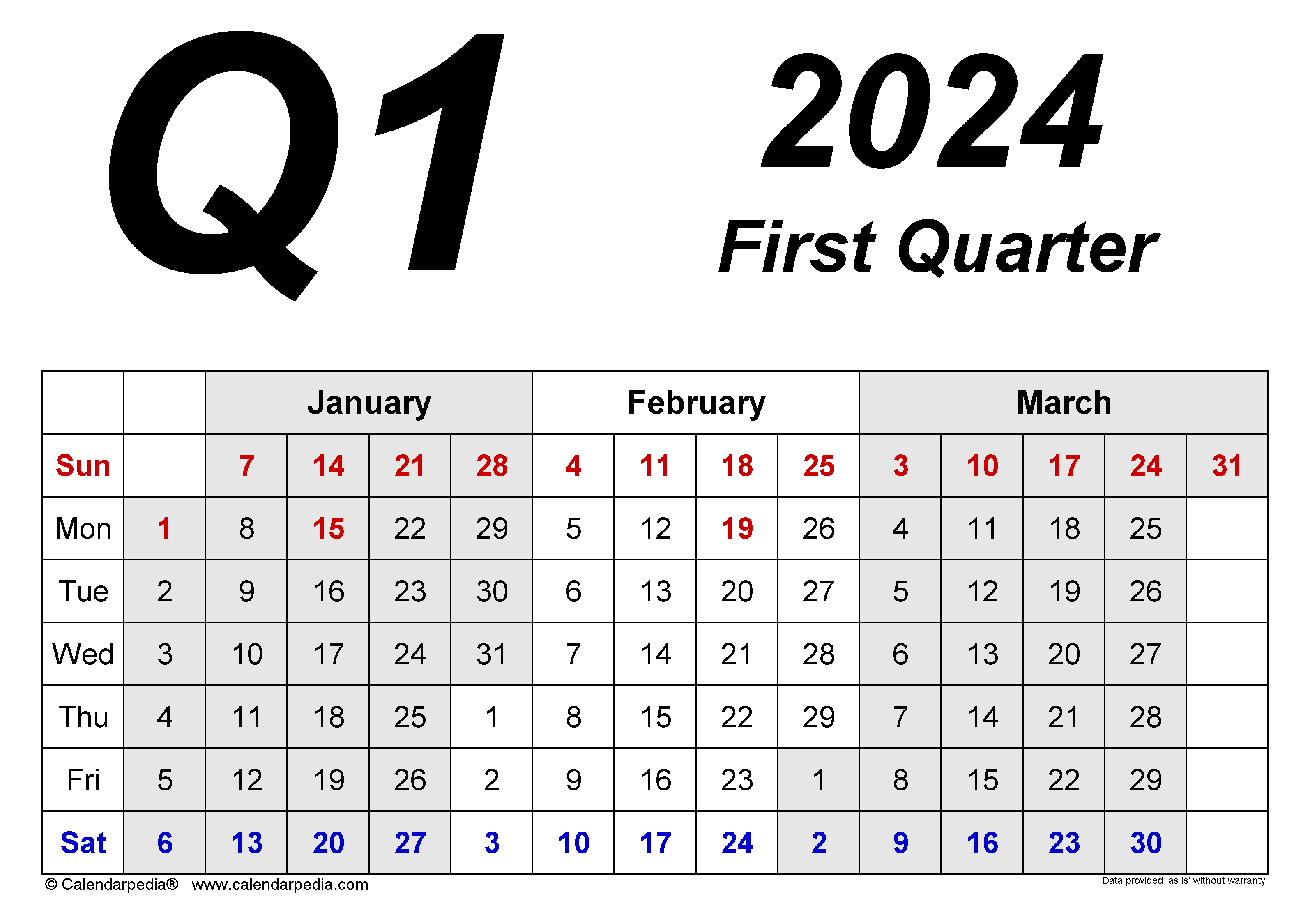

2nd Quarter 2024 Tax Deadline Corrie Karisa