Today, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education or creative projects, or just adding an individual touch to your area, Tax Write Off Rules have become an invaluable resource. We'll take a dive through the vast world of "Tax Write Off Rules," exploring what they are, how to find them and how they can improve various aspects of your daily life.

Get Latest Tax Write Off Rules Below

Tax Write Off Rules

Tax Write Off Rules -

The instant asset write off does not apply for assets you start to hold and first use or have installed ready for use for a taxable purpose from 7 30pm AEDT on 6 October 2020 to 30 June 2023 You must immediately deduct the business portion of the asset s cost under temporary full expensing

Understanding write offs and the difference between a tax write off and a write down can help you reduce taxable income and increase the accuracy of how you record a business financial

Printables for free include a vast range of downloadable, printable materials online, at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages and more. The appeal of printables for free is in their versatility and accessibility.

More of Tax Write Off Rules

How Tax Write Offs Really Work WealthFit

How Tax Write Offs Really Work WealthFit

A Section 179 expense is a business asset that can be written off for tax purposes right away rather than being depreciated over time In 2023 taxes filed in 2024 the maximum Section 179

15 Common Tax Write Offs You Can Claim On Your Next Return Ellen Chang Contributor Reviewed Kemberley Washington Certified Public Accountant Updated Mar 1 2024 6 06pm Editorial

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Flexible: We can customize print-ready templates to your specific requirements, whether it's designing invitations and schedules, or even decorating your home.

-

Educational Use: The free educational worksheets can be used by students from all ages, making them an invaluable source for educators and parents.

-

Convenience: You have instant access an array of designs and templates will save you time and effort.

Where to Find more Tax Write Off Rules

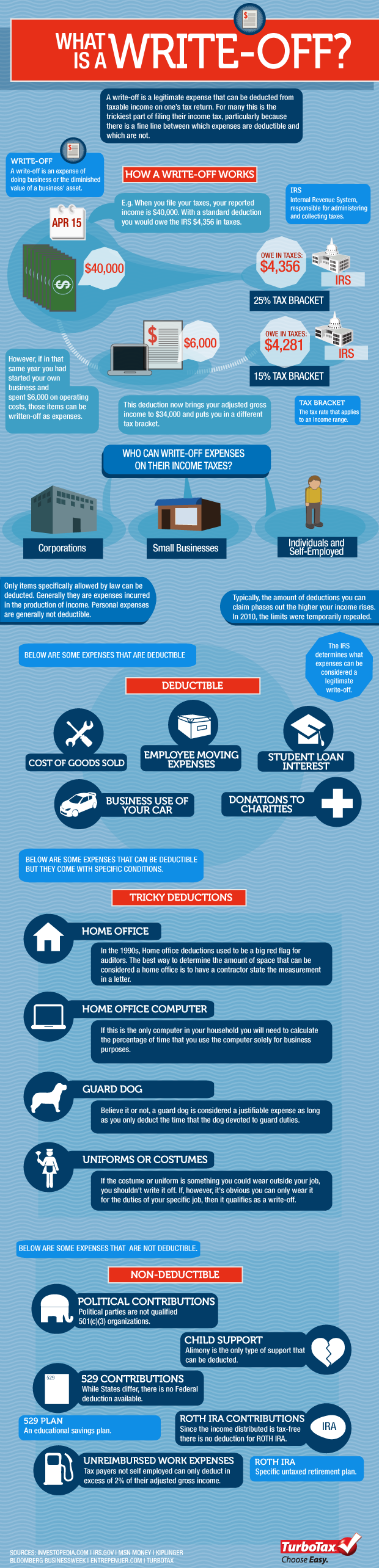

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

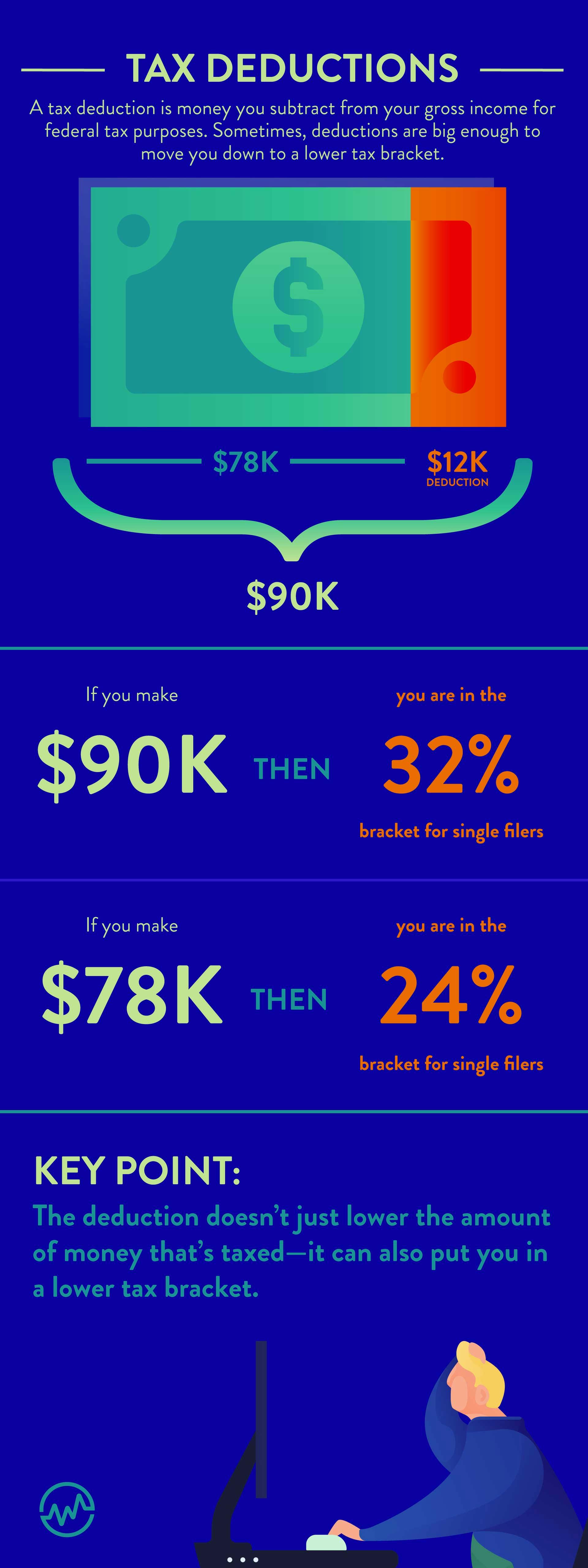

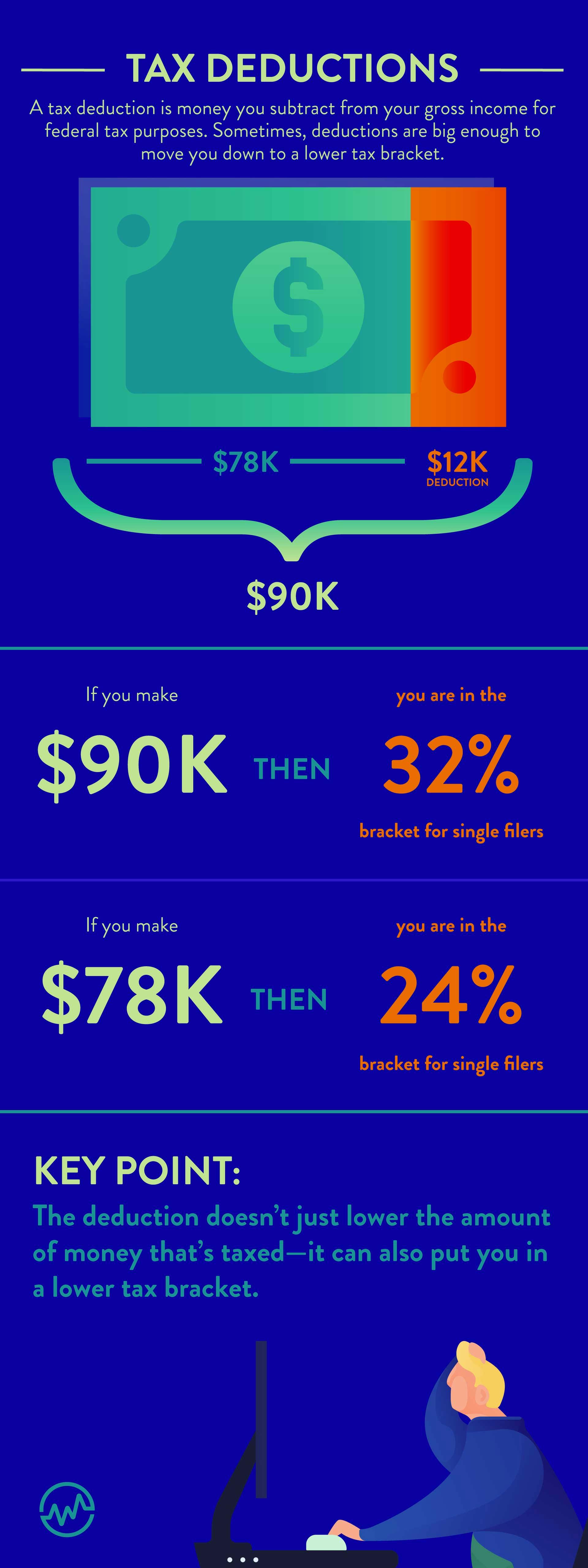

A tax write off also known as a tax deduction is an expense you can subtract from your taxable income A lower taxable income means a smaller tax bill That s why tax deductions are such a powerful financial tool for self employed people whose tax bills can be uncomfortably high without them Who can write off expenses

Tax write offs are pretty simple to understand They are deductions that lower your taxable income However using them correctly is important if you want to get all the benefits

After we've peaked your interest in Tax Write Off Rules we'll explore the places you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Tax Write Off Rules for a variety needs.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs covered cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing Tax Write Off Rules

Here are some unique ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Write Off Rules are an abundance of practical and innovative resources for a variety of needs and interest. Their availability and versatility make they a beneficial addition to each day life. Explore the world of Tax Write Off Rules right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can download and print these tools for free.

-

Can I use the free printables in commercial projects?

- It's based on specific rules of usage. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with Tax Write Off Rules?

- Some printables may come with restrictions concerning their use. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using an printer, or go to a local print shop for the highest quality prints.

-

What software must I use to open printables that are free?

- Many printables are offered in the PDF format, and is open with no cost software such as Adobe Reader.

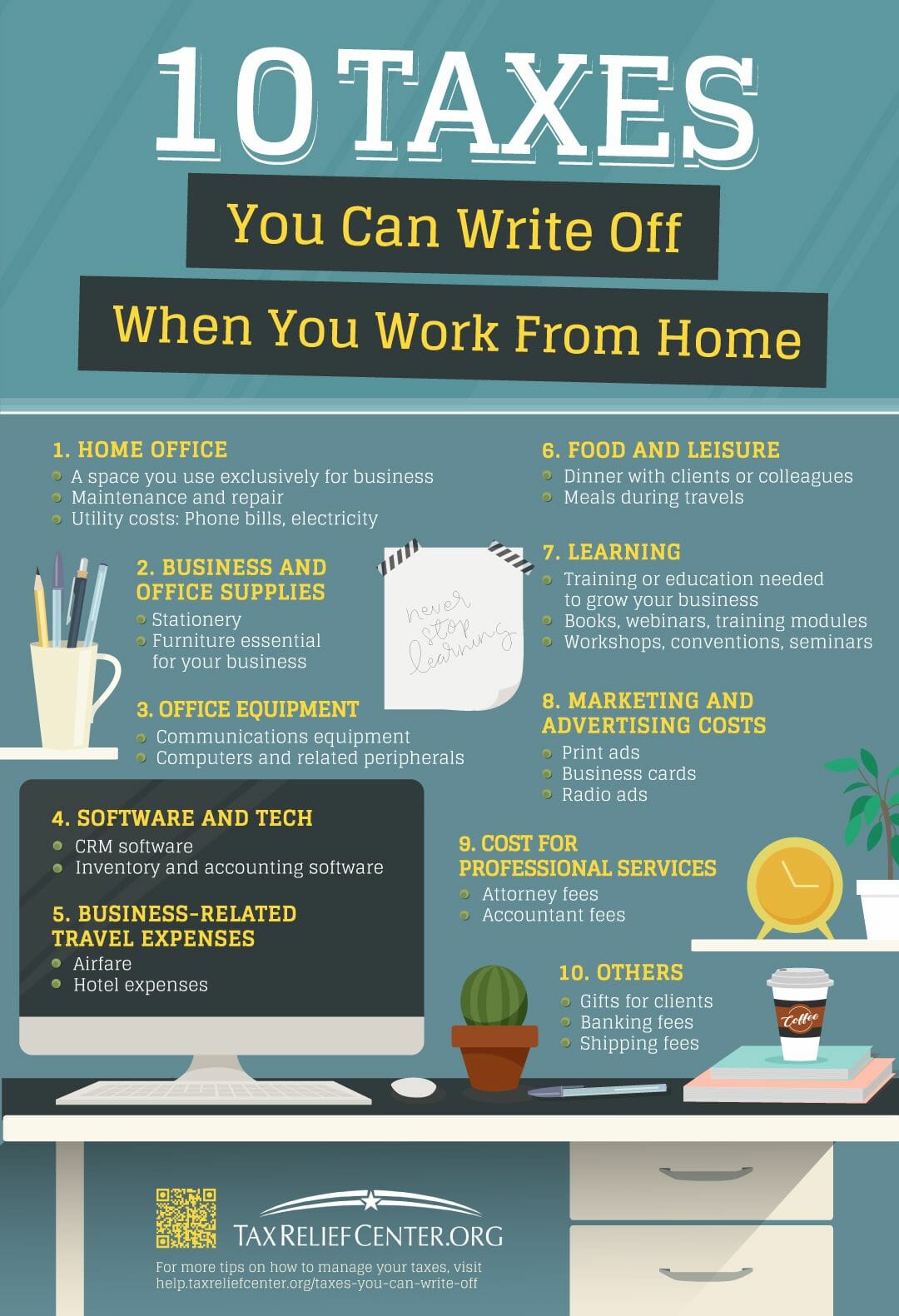

How To Write A Tax Write Off Cheat Sheet Business Tax Tax Write Offs

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

Check more sample of Tax Write Off Rules below

Tax Write Off Cheat Sheet Payhip

Tax Write off Rules

Tax Write Off Cheat Sheet For Authors Read Write Hustle Cheat

How Do Tax Write Offs Work WealthFit

What Is A Tax Write Off Definition And Examples BooksTime

Tax Write Offs Your Guide To All Itemized Deductions Business Tax

https://www.investopedia.com/terms/w/write-off.asp

Understanding write offs and the difference between a tax write off and a write down can help you reduce taxable income and increase the accuracy of how you record a business financial

https://www.freshbooks.com/hub/accounting/write-offs

Key Takeaways Tax write offs have a very specific definition you must know to take advantage of them for your business A tax write off is a business expense that can be claimed as a tax deduction on a federal income tax return lowering the amount the business will be assessed for taxes

Understanding write offs and the difference between a tax write off and a write down can help you reduce taxable income and increase the accuracy of how you record a business financial

Key Takeaways Tax write offs have a very specific definition you must know to take advantage of them for your business A tax write off is a business expense that can be claimed as a tax deduction on a federal income tax return lowering the amount the business will be assessed for taxes

How Do Tax Write Offs Work WealthFit

Tax Write off Rules

What Is A Tax Write Off Definition And Examples BooksTime

Tax Write Offs Your Guide To All Itemized Deductions Business Tax

Here Are The 10 Insanely Awesome Business Tax Deductions Write offs You

Most Americans Think They re Taking All Their Entitled Deductions Are

Most Americans Think They re Taking All Their Entitled Deductions Are

Tax Prep List I Love My Lists Tax Appointment Business Tax