In the age of digital, when screens dominate our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add an individual touch to your home, printables for free can be an excellent resource. The following article is a take a dive into the world "Tax Form For Small Business Deductions," exploring their purpose, where they are, and how they can add value to various aspects of your lives.

Get Latest Tax Form For Small Business Deductions Below

Tax Form For Small Business Deductions

Tax Form For Small Business Deductions -

Businesses use Form 720 to report the excise taxes on certain business activities Who needs to file Form 720 Businesses that sell products or services with excise tax liability should use Form 720 Notable dates The IRS wants Form 720 by the last day of the month following the end of a quarter

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

The Tax Form For Small Business Deductions are a huge selection of printable and downloadable materials that are accessible online for free cost. They come in many forms, like worksheets templates, coloring pages and much more. The appealingness of Tax Form For Small Business Deductions is their flexibility and accessibility.

More of Tax Form For Small Business Deductions

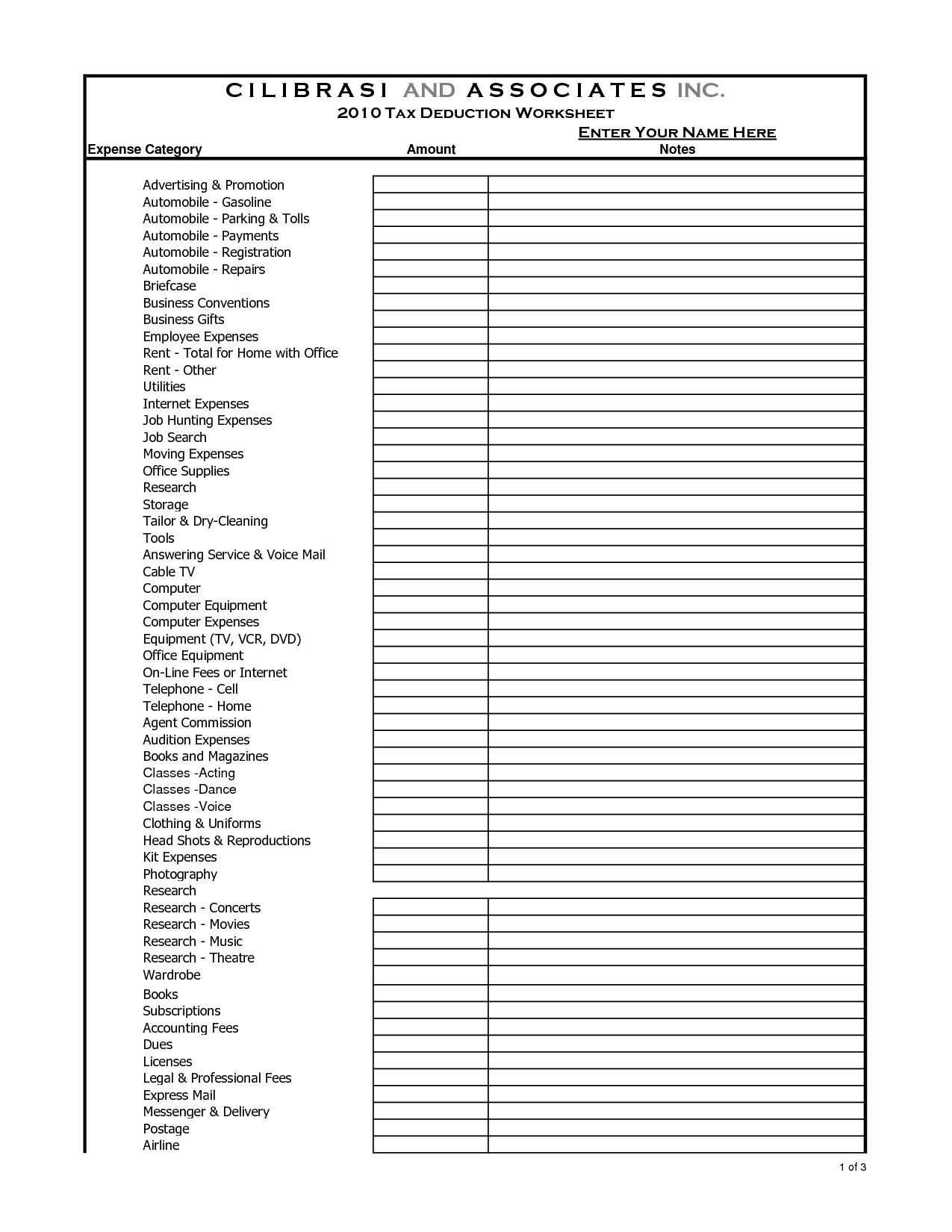

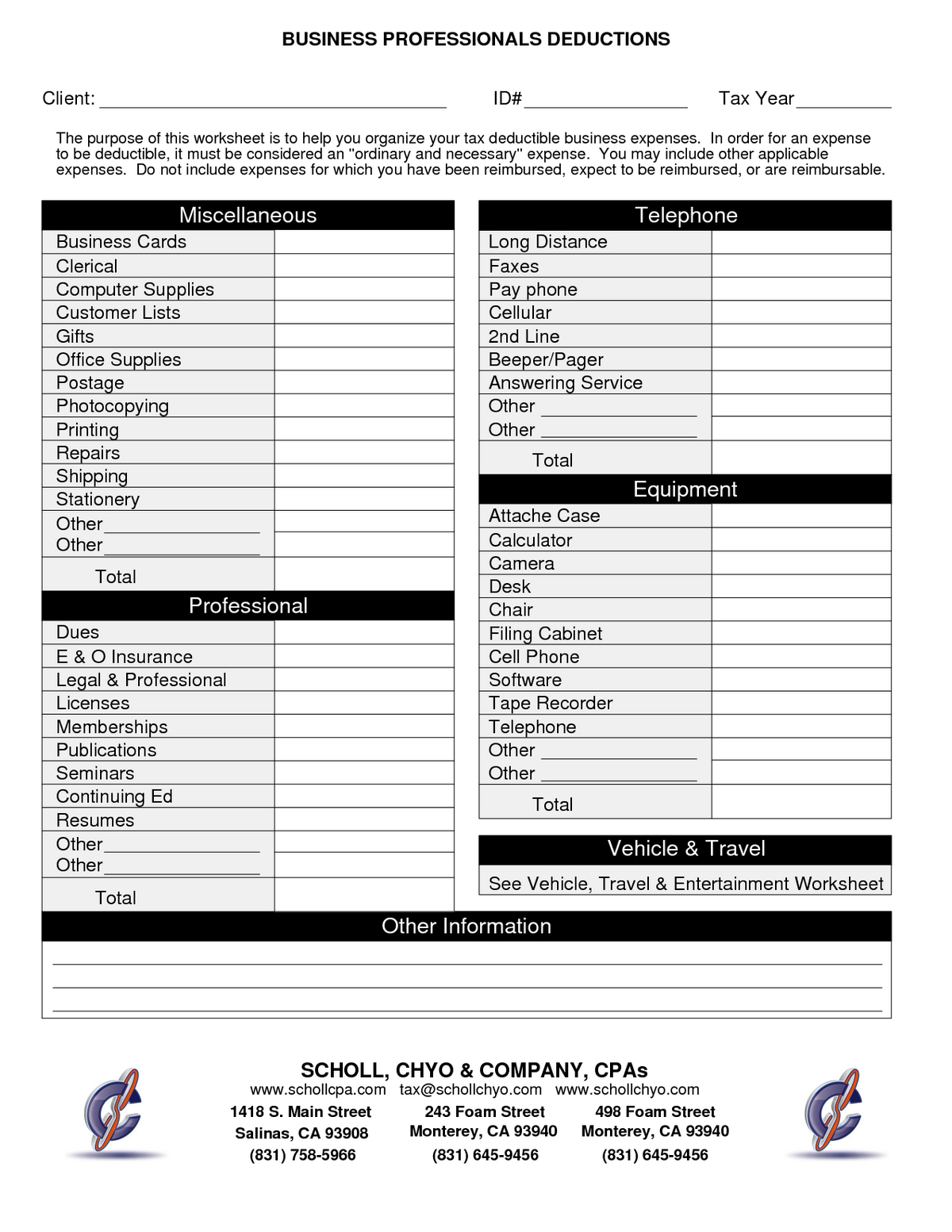

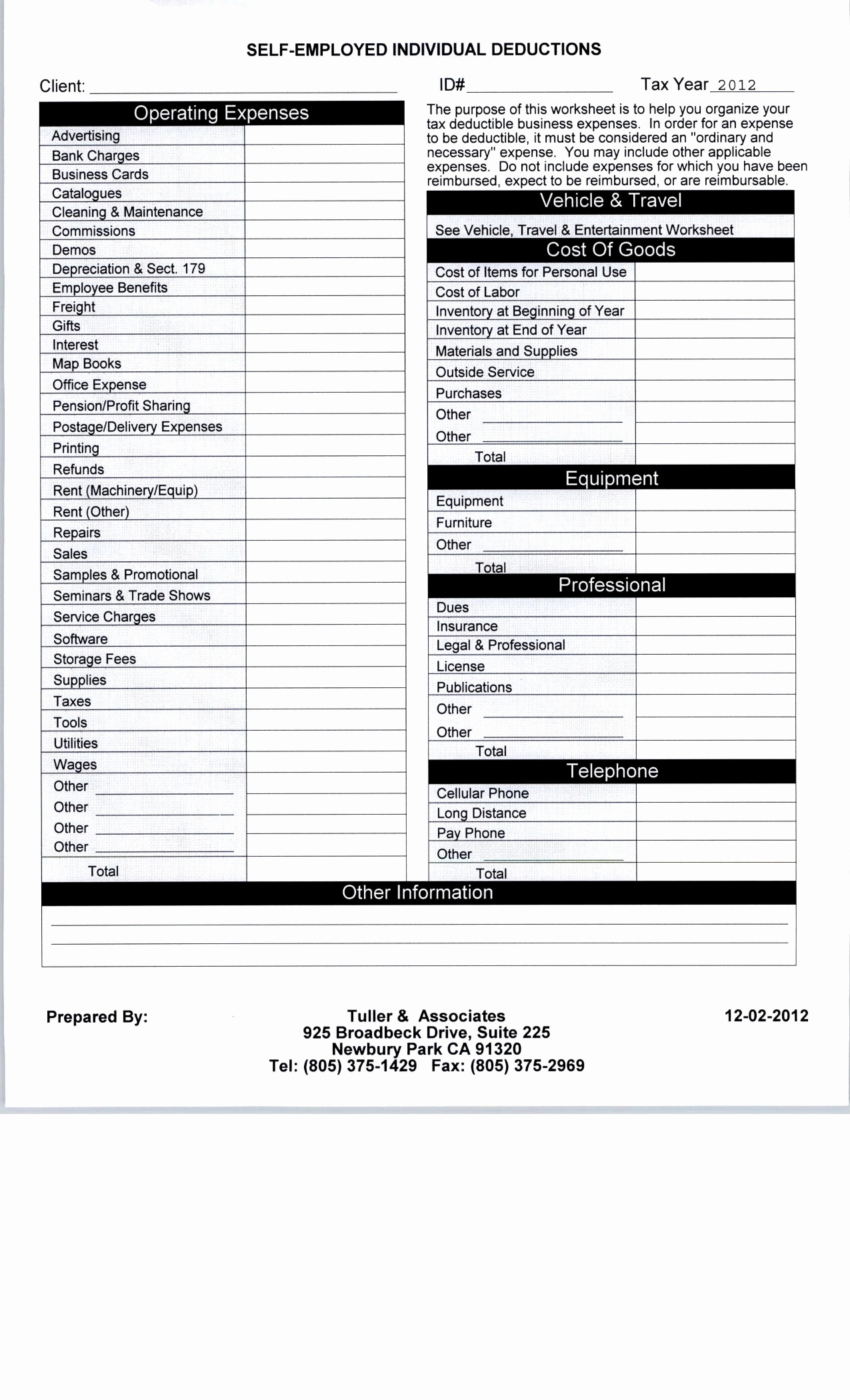

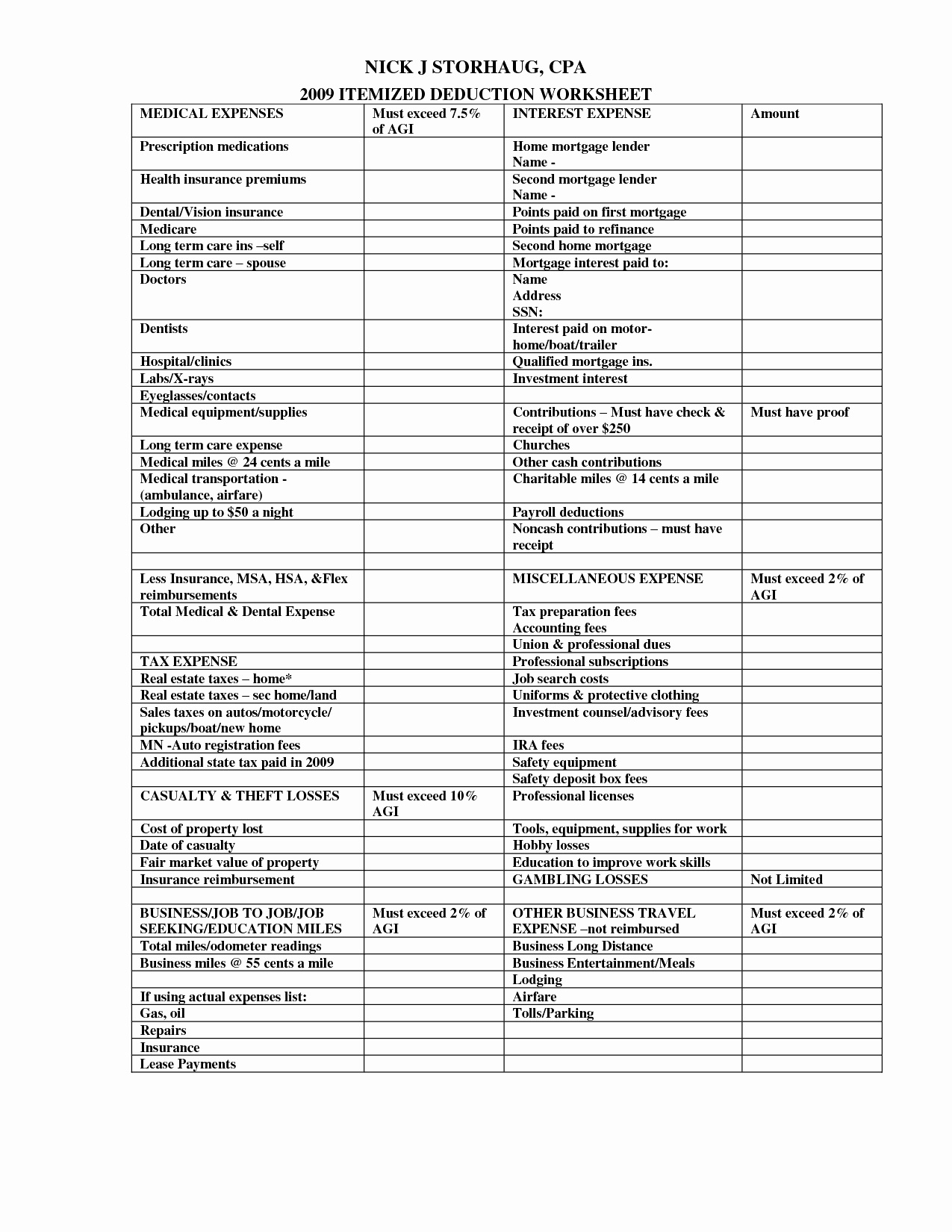

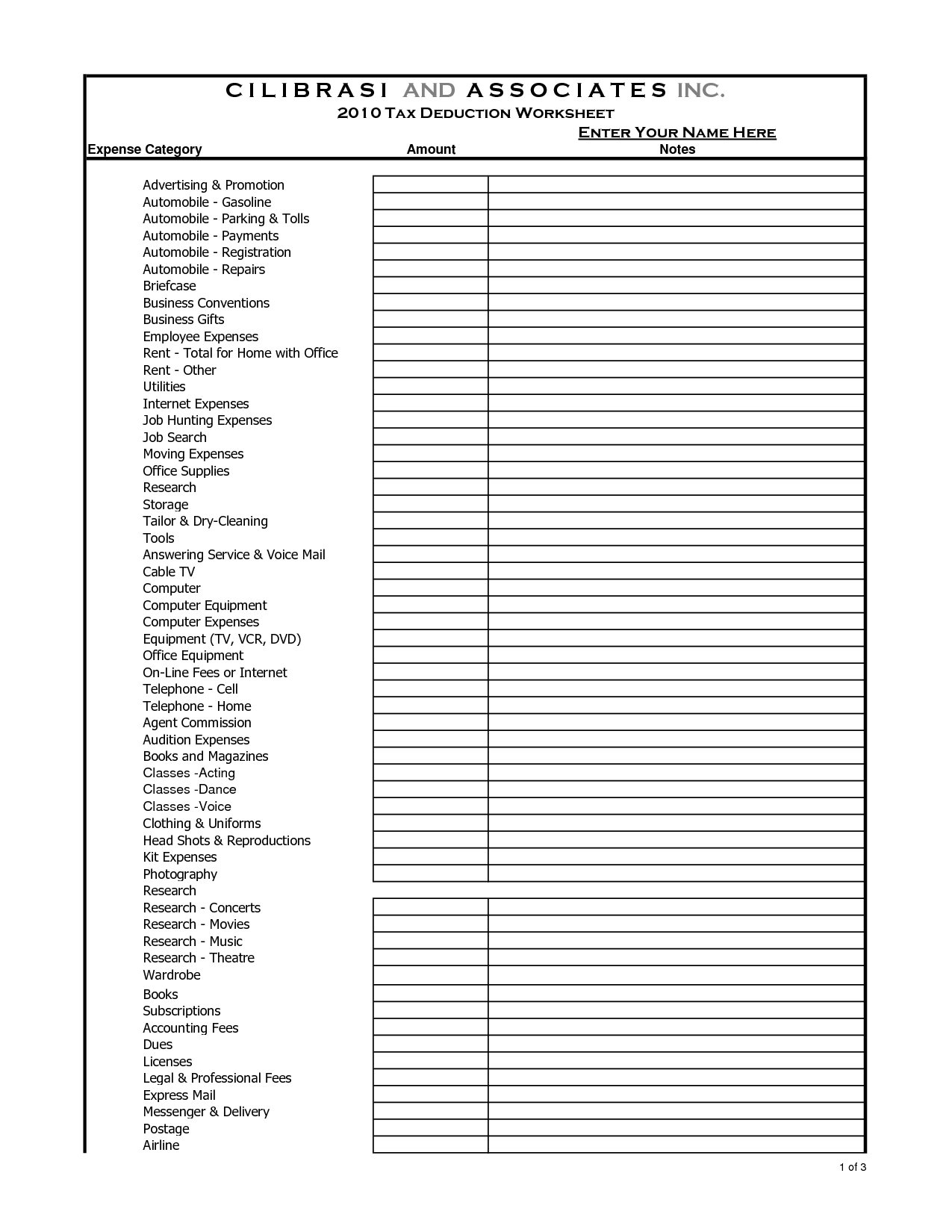

Small Business Tax Deductions Worksheet

Small Business Tax Deductions Worksheet

For tax years beginning after 2017 you may be entitled to take a deduction of up to 20 of your qualified business income from your qualified trade or business plus 20 of the aggregate amount of qualified real estate investment trust REIT and qualified publicly traded partnership income

Form 1040 Schedule C is the main form that you must use to take your small business tax deductions It contains a long list of categories for deductions you can take for common business expenses

Tax Form For Small Business Deductions have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

customization Your HTML0 customization options allow you to customize the templates to meet your individual needs when it comes to designing invitations planning your schedule or even decorating your home.

-

Education Value The free educational worksheets can be used by students of all ages, making them a vital instrument for parents and teachers.

-

Accessibility: You have instant access the vast array of design and templates cuts down on time and efforts.

Where to Find more Tax Form For Small Business Deductions

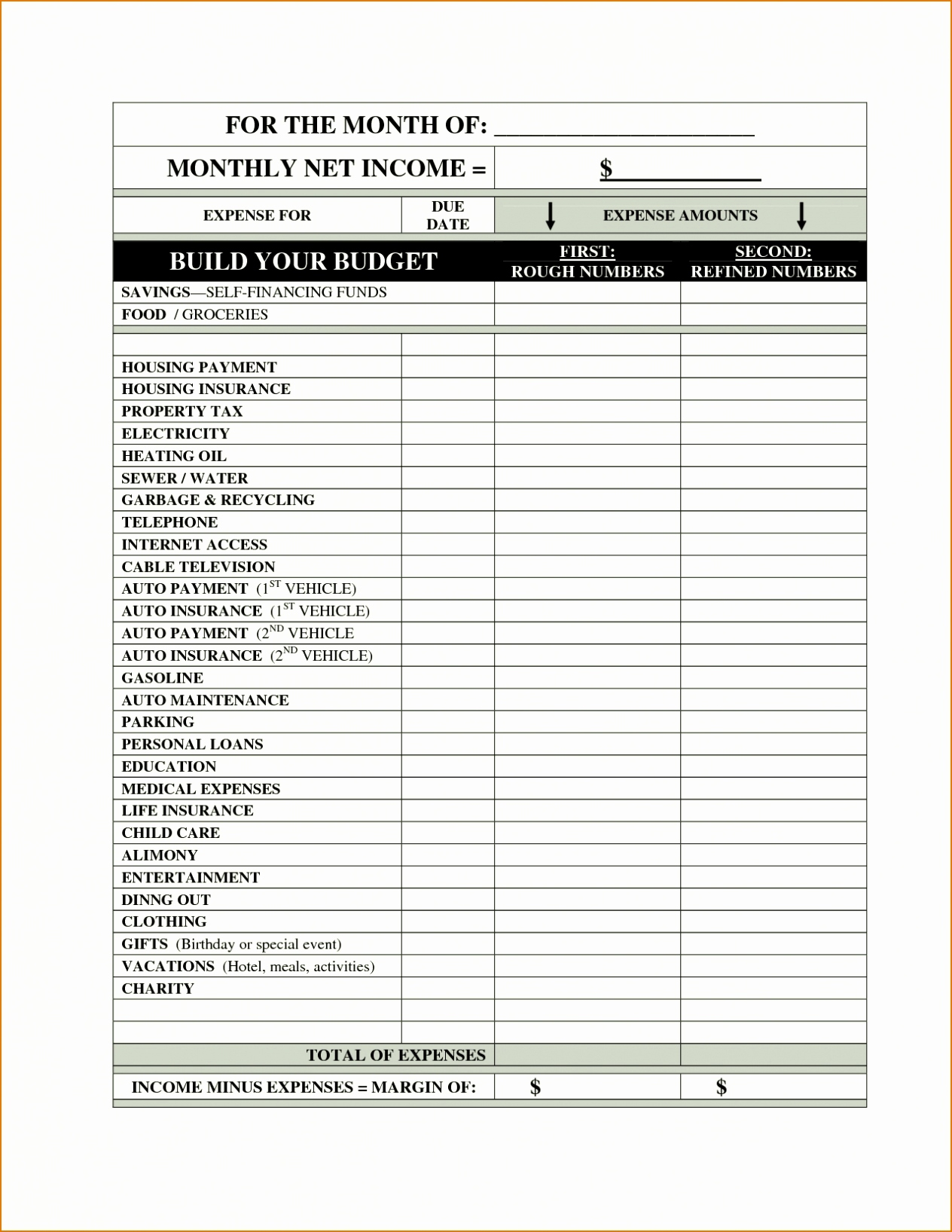

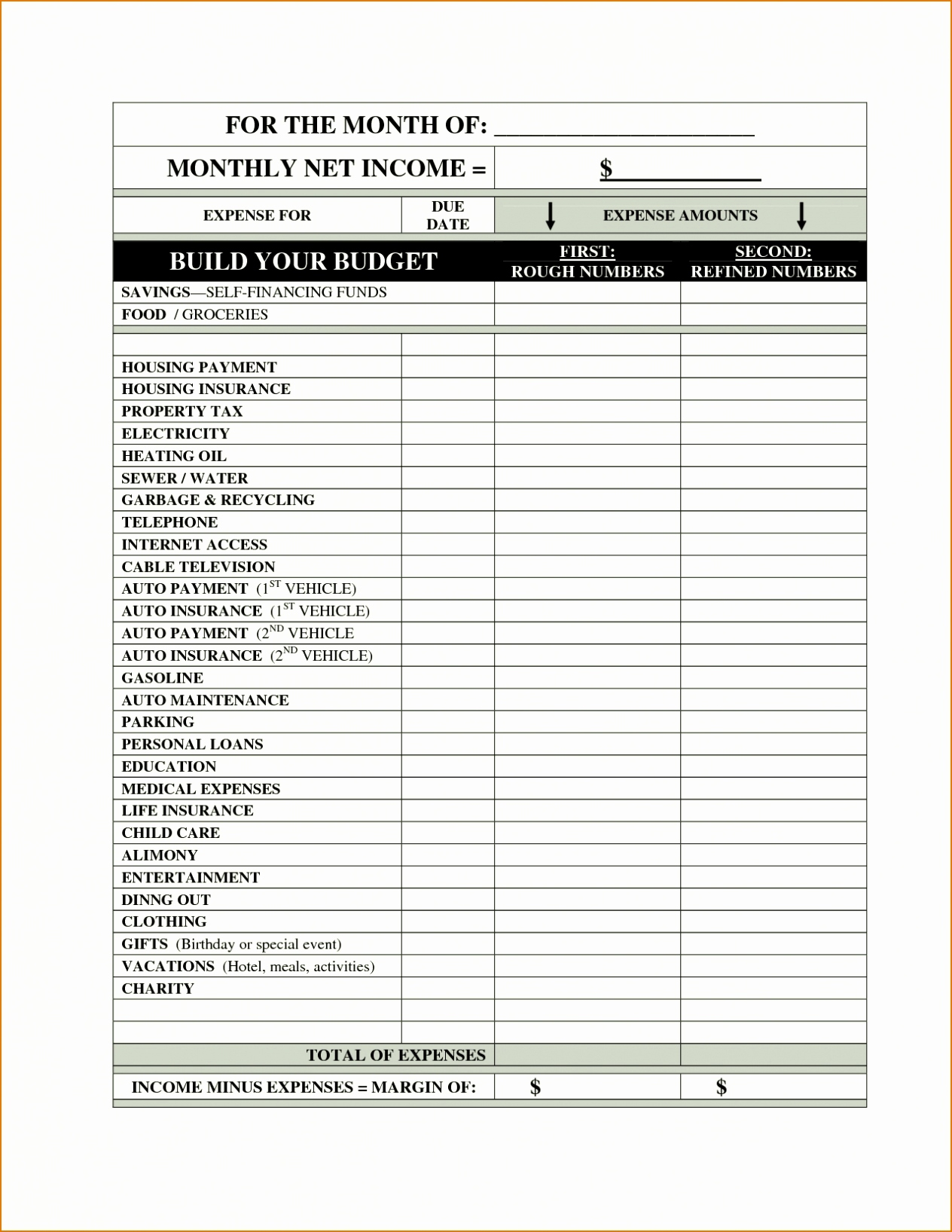

Farm Expense Spreadsheet Template Throughout Spreadsheet For Taxes

Farm Expense Spreadsheet Template Throughout Spreadsheet For Taxes

We ve pared down 23 of the highest impact and most generous tax deductions and write offs available to small businesses in 2024 examples of each and how much you can deduct These tax breaks include Startup costs Home office Retirement plan contributions Depreciation

The top 17 small business tax deductions Each of these expenses are tax deductible Consider this a checklist of small business tax write offs And remember some of the deductions in this list may not be available to your small business

Now that we've piqued your curiosity about Tax Form For Small Business Deductions, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Tax Form For Small Business Deductions to suit a variety of motives.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs covered cover a wide selection of subjects, including DIY projects to planning a party.

Maximizing Tax Form For Small Business Deductions

Here are some inventive ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Form For Small Business Deductions are an abundance of practical and imaginative resources catering to different needs and interests. Their access and versatility makes them a wonderful addition to your professional and personal life. Explore the plethora of Tax Form For Small Business Deductions now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can download and print these items for free.

-

Can I utilize free templates for commercial use?

- It's determined by the specific usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may have restrictions concerning their use. You should read the terms and conditions set forth by the designer.

-

How do I print printables for free?

- Print them at home using a printer or visit a local print shop to purchase high-quality prints.

-

What program do I need to run Tax Form For Small Business Deductions?

- Most PDF-based printables are available in the format of PDF, which can be opened with free software such as Adobe Reader.

Hair Stylist Tax Deduction Worksheet Pdf Fill Online Printable

Worksheet For Taxes Db excel

Check more sample of Tax Form For Small Business Deductions below

Donation Value Guide 2018 Spreadsheet With Irs Donation Value Guide

10 Most Common Small Business Tax Deductions Infographic

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Realtor Tax Deductions Worksheet Form Fill Out And Sign Printable PDF

Business Tax List Of Business Tax Deductions

The Master List Of All Types Of Tax Deductions INFOGRAPHIC

https://www.irs.gov/forms-pubs/about-schedule-c-form-1040

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

https://quickbooks.intuit.com/accounting/small-business-tax-deductions

Any legal fees that your small business pays can qualify as tax deductible including any fees in legal cases that you didn t win Percentage deductible 100 Eligibility The expenses you incur must be considered ordinary and necessary to the business Example deductions Fees for resolving tax issues Fees related to

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

Any legal fees that your small business pays can qualify as tax deductible including any fees in legal cases that you didn t win Percentage deductible 100 Eligibility The expenses you incur must be considered ordinary and necessary to the business Example deductions Fees for resolving tax issues Fees related to

Realtor Tax Deductions Worksheet Form Fill Out And Sign Printable PDF

10 Most Common Small Business Tax Deductions Infographic

Business Tax List Of Business Tax Deductions

The Master List Of All Types Of Tax Deductions INFOGRAPHIC

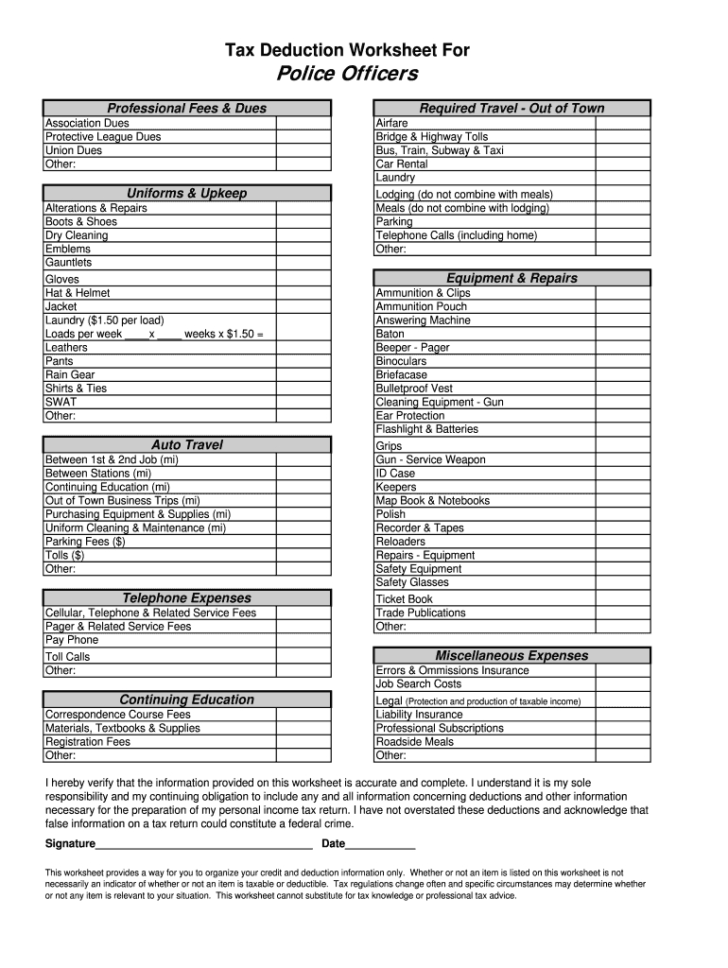

Fillable Online Police Officer Tax Deduction Worksheet Db excel

Commercial Loan Comparison Spreadsheet Spreadsheet Downloa Commercial

Commercial Loan Comparison Spreadsheet Spreadsheet Downloa Commercial

5 Itemized Tax Deduction Worksheet Worksheeto