In the digital age, where screens have become the dominant feature of our lives, the charm of tangible printed materials isn't diminishing. Whatever the reason, whether for education as well as creative projects or simply adding some personal flair to your space, Do 1099 Employees Get Pay Stubs can be an excellent source. Through this post, we'll dive deeper into "Do 1099 Employees Get Pay Stubs," exploring what they are, how to get them, as well as how they can enrich various aspects of your daily life.

Get Latest Do 1099 Employees Get Pay Stubs Below

Do 1099 Employees Get Pay Stubs

Do 1099 Employees Get Pay Stubs -

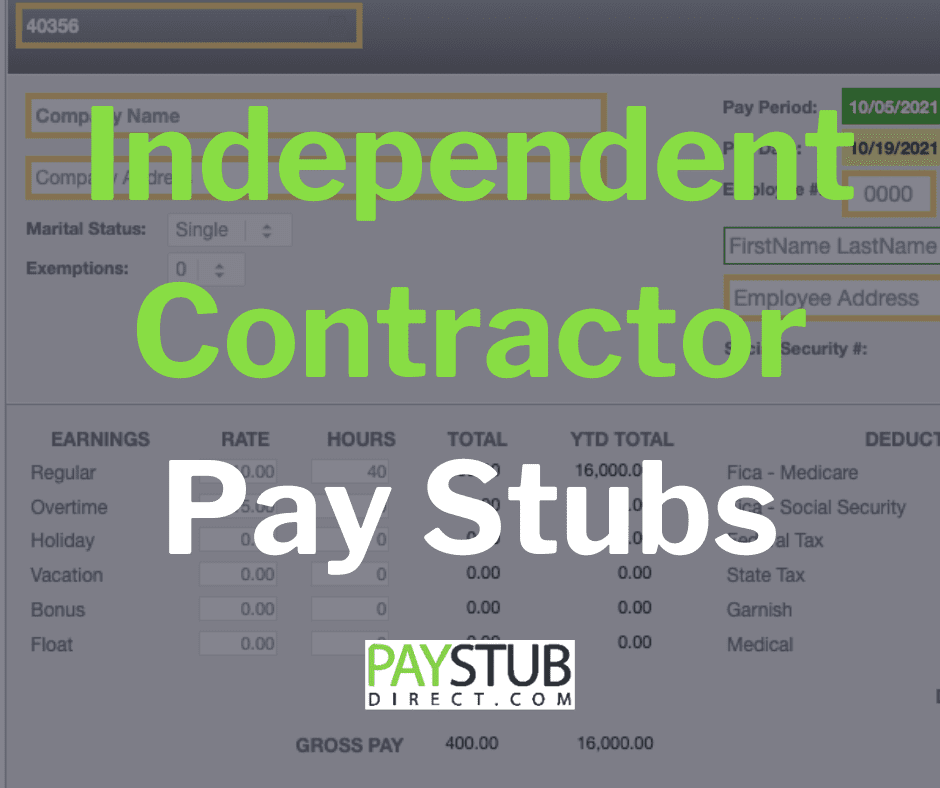

A 1099 employee is a self employed person who works in contract based employment roles usually to complete a specific project or job 1099 workers aren t W 2 employees and receive pay based on their contract instead of receiving a salary or traditional wages

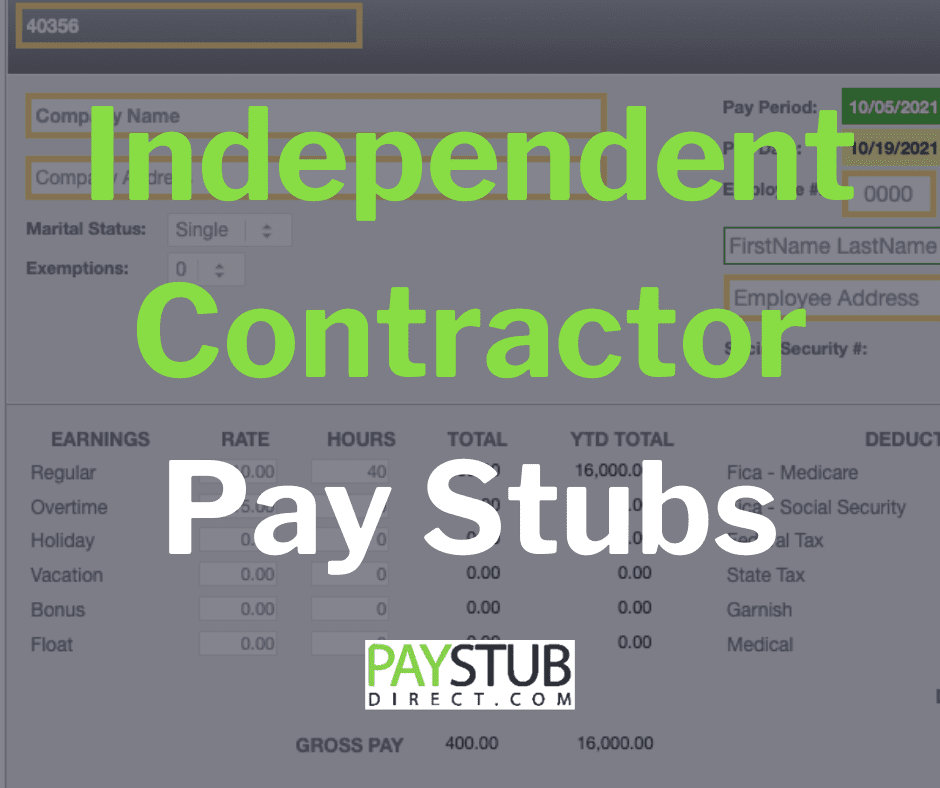

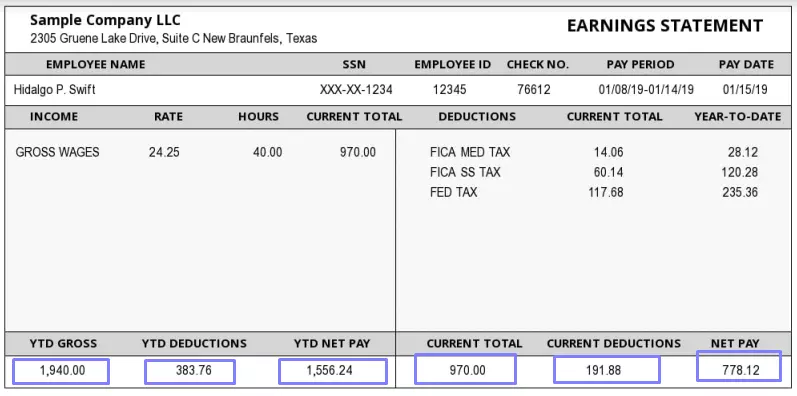

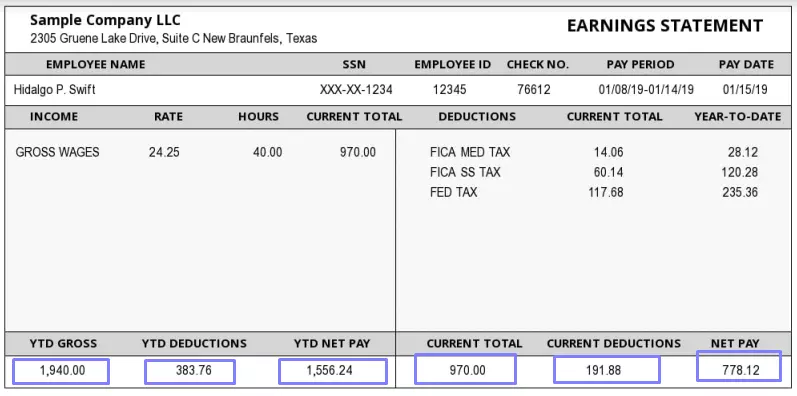

The pay stub an independent contractor generates is just as detailed and certified as the paychecks employers provide their employees but only if done rightly

Do 1099 Employees Get Pay Stubs encompass a wide range of printable, free documents that can be downloaded online at no cost. These resources come in various kinds, including worksheets templates, coloring pages, and many more. One of the advantages of Do 1099 Employees Get Pay Stubs lies in their versatility as well as accessibility.

More of Do 1099 Employees Get Pay Stubs

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

To cut through the suspense and answer the question directly no 1099 employees do not typically receive traditional paystubs However there s more to this answer than meets the eye

Workers who receive a regularly paid wage such as a salary are more likely to be considered employees not independent contractors In fact method of payment is one of the key financial criteria that the IRS looks at when determining worker classification

Do 1099 Employees Get Pay Stubs have risen to immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: You can tailor print-ready templates to your specific requirements such as designing invitations and schedules, or decorating your home.

-

Educational Value The free educational worksheets provide for students from all ages, making them a useful tool for parents and teachers.

-

It's easy: instant access numerous designs and templates saves time and effort.

Where to Find more Do 1099 Employees Get Pay Stubs

Walgreens Pay Stub At Home Scrabblecardgamequickly

Walgreens Pay Stub At Home Scrabblecardgamequickly

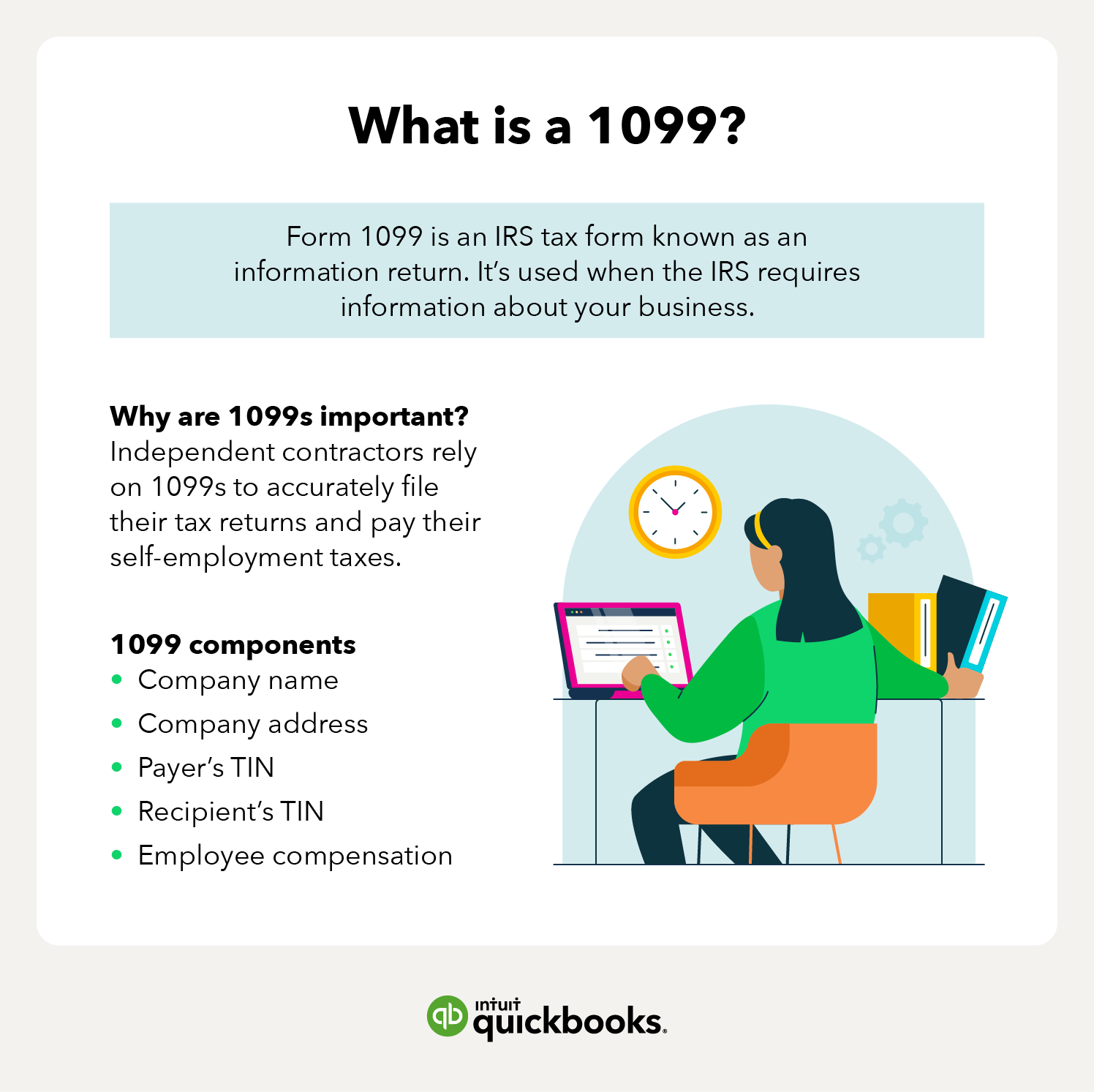

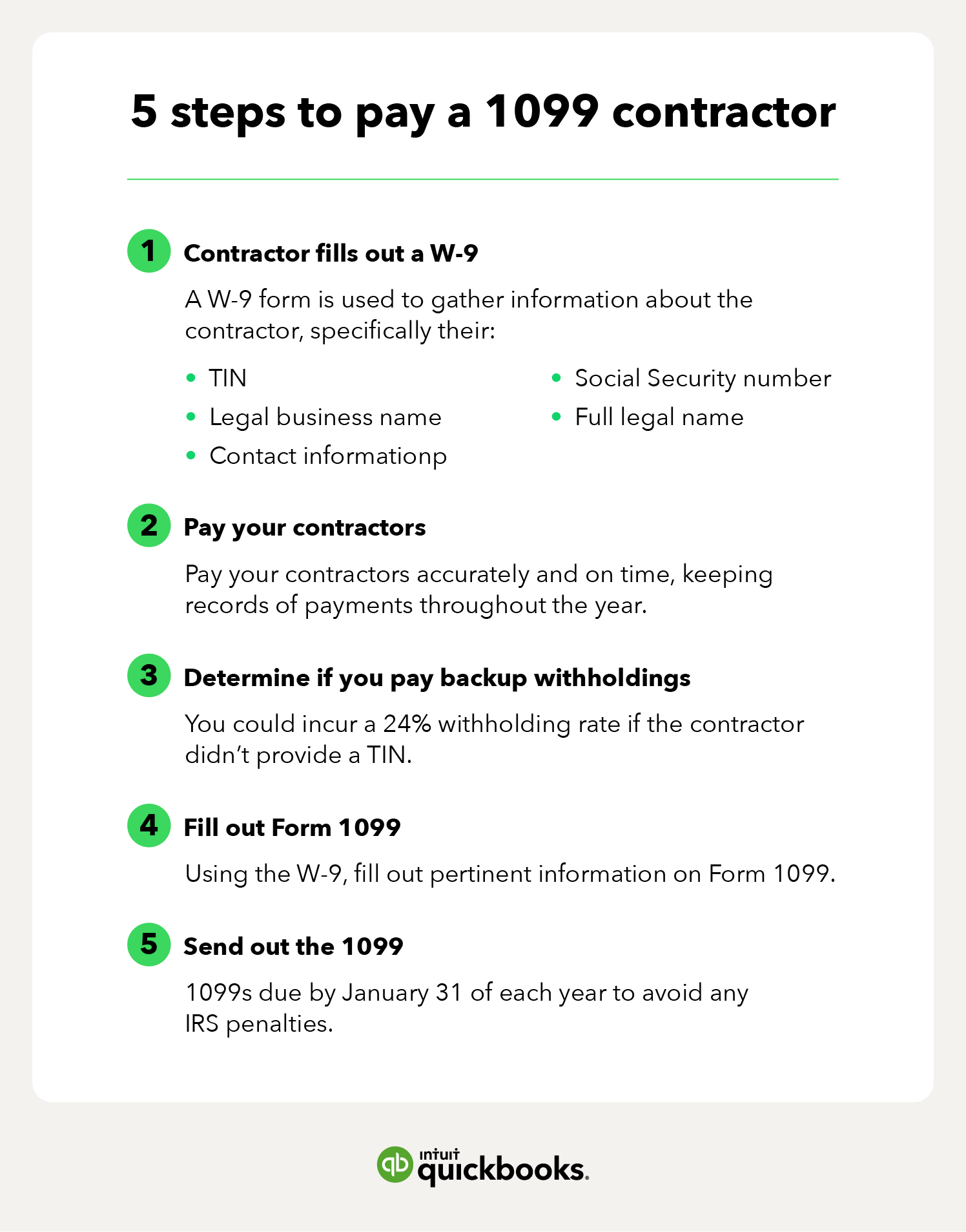

For your cash flow bringing on a contingency workforce rather than part time or full time employees may be the best approach But as a small business owner it s important to know how to pay 1099 workers and how to report those contractor payments to the Internal Revenue Service IRS

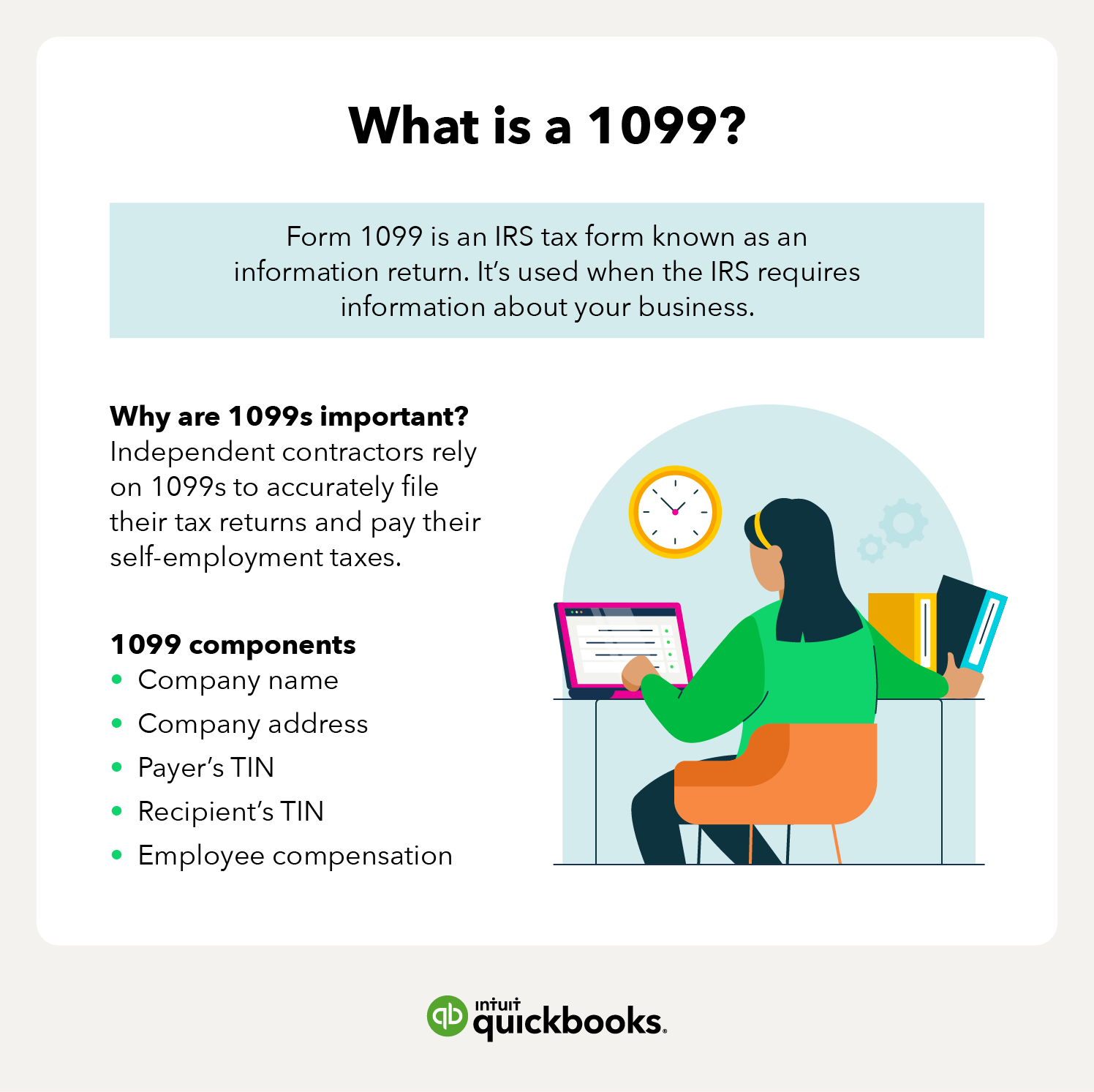

Though many companies use the term 1099 employee it isn t really accurate because the IRS classifies workers who receive 1099s as nonemployees A nonemployee is subject to different working conditions and doesn t receive the same benefits and payroll deductions as an employee

Since we've got your interest in Do 1099 Employees Get Pay Stubs Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Do 1099 Employees Get Pay Stubs for all purposes.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing including flashcards, learning materials.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- The blogs are a vast range of topics, ranging from DIY projects to planning a party.

Maximizing Do 1099 Employees Get Pay Stubs

Here are some inventive ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Do 1099 Employees Get Pay Stubs are a treasure trove of innovative and useful resources that cater to various needs and desires. Their access and versatility makes them a great addition to both professional and personal lives. Explore the world of Do 1099 Employees Get Pay Stubs and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can download and print these files for free.

-

Does it allow me to use free printables for commercial purposes?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with Do 1099 Employees Get Pay Stubs?

- Certain printables may be subject to restrictions regarding usage. Be sure to read the terms of service and conditions provided by the creator.

-

How do I print Do 1099 Employees Get Pay Stubs?

- You can print them at home using a printer or visit the local print shop for premium prints.

-

What software is required to open printables that are free?

- The majority of printables are as PDF files, which is open with no cost software like Adobe Reader.

Independent Contractor Pay Stub Template Luxury 7 Independent

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

Check more sample of Do 1099 Employees Get Pay Stubs below

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

1099 Paycheck Stub

Free 1099 Tax Forms Printable

1099 Vs W2 Difference Between Independent Contractors Employees

Blank Payroll Check Stub Template Payroll Template Payroll Checks

What Is A Pay Stub Do I Need To Provide Pay Stubs For My Employees

https://www.techmoths.com/business/how-to-generate-pay-stub-for...

The pay stub an independent contractor generates is just as detailed and certified as the paychecks employers provide their employees but only if done rightly

https://www.joist.com/blog/what-are-the-rules-for-1099-employees

Employee Classification Rules The IRS has rules to help you determine whether a worker is an independent contractor There are three main factors to consider Behavioral Do you direct or manage how the worker performs their tasks Financial Do you influence the financial aspects of the worker s job

The pay stub an independent contractor generates is just as detailed and certified as the paychecks employers provide their employees but only if done rightly

Employee Classification Rules The IRS has rules to help you determine whether a worker is an independent contractor There are three main factors to consider Behavioral Do you direct or manage how the worker performs their tasks Financial Do you influence the financial aspects of the worker s job

1099 Vs W2 Difference Between Independent Contractors Employees

1099 Paycheck Stub

Blank Payroll Check Stub Template Payroll Template Payroll Checks

What Is A Pay Stub Do I Need To Provide Pay Stubs For My Employees

Pay Stub Template For 1099 Employee

Pin On Beautiful Professional Template

Pin On Beautiful Professional Template

Pin On Taxes 1099 Form