Today, when screens dominate our lives, the charm of tangible printed items hasn't gone away. Whatever the reason, whether for education as well as creative projects or just adding the personal touch to your space, Can You Pay An Employee 1099 And W2 are now a vital source. Here, we'll dive deeper into "Can You Pay An Employee 1099 And W2," exploring what they are, how they are available, and how they can improve various aspects of your lives.

Get Latest Can You Pay An Employee 1099 And W2 Below

Can You Pay An Employee 1099 And W2

Can You Pay An Employee 1099 And W2 -

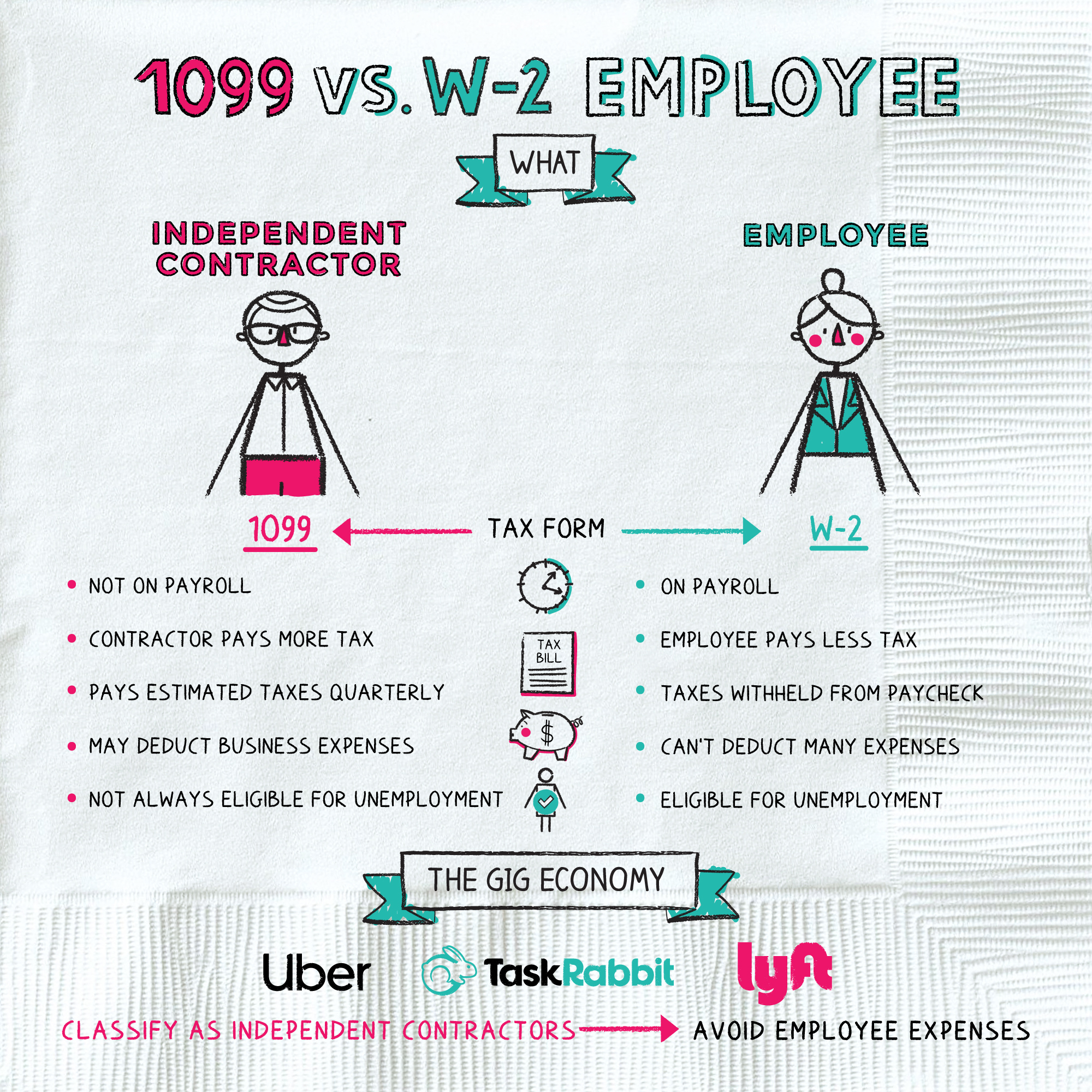

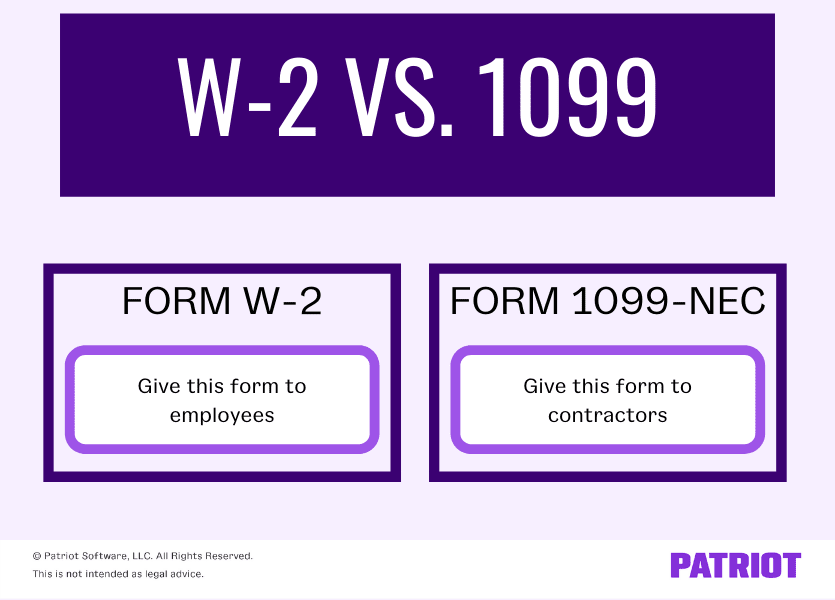

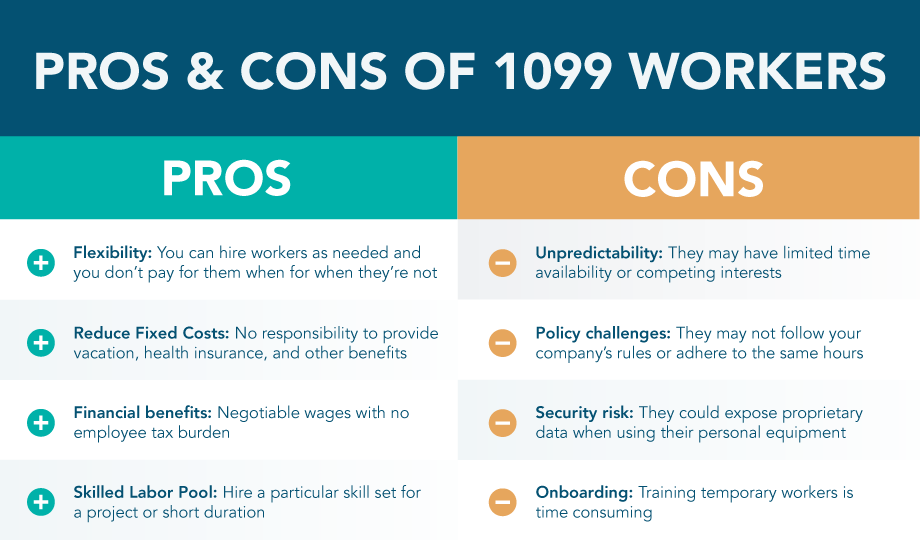

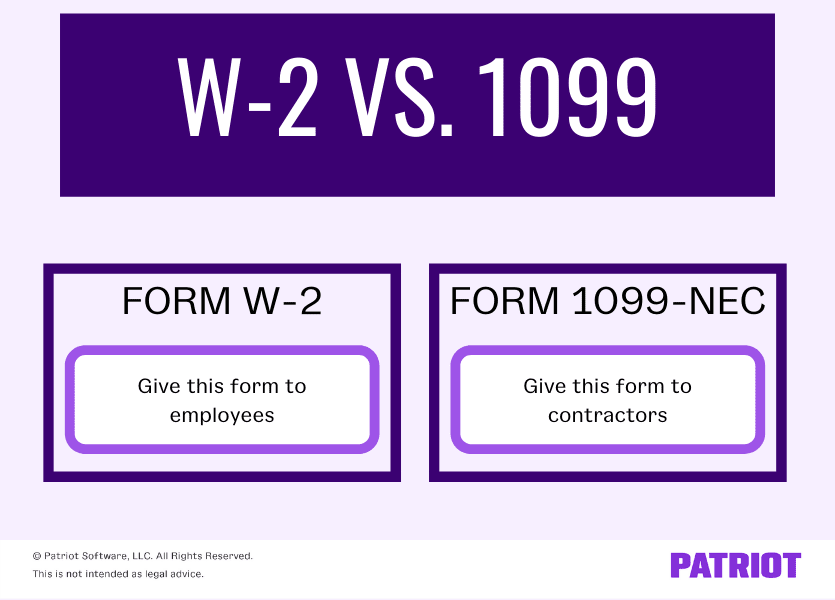

Entities provide a Form 1099 Misc to independent contractors and Form W 2 to employees See this article on worker classification for more information However

First off what s the difference between a 1099 and W 2 Form W 2 is used to report annual wages earned by an employee and any withholdings from income

Can You Pay An Employee 1099 And W2 encompass a wide assortment of printable, downloadable items that are available online at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and many more. The value of Can You Pay An Employee 1099 And W2 is their versatility and accessibility.

More of Can You Pay An Employee 1099 And W2

Hiring 1099 Vs W 2 Employees Dun And Bradstreet

Hiring 1099 Vs W 2 Employees Dun And Bradstreet

You must also file a W 2 for any employee for whom you withheld taxes even if you paid them less than 600 What Is a 1099 A 1099 NEC is an IRS form that

There are two situations in which an independent contractor can receive both Forms 1099 and W2 from the same employer The first is if the worker performed duties

Can You Pay An Employee 1099 And W2 have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: Your HTML0 customization options allow you to customize printables to your specific needs such as designing invitations planning your schedule or even decorating your home.

-

Educational Value Downloads of educational content for free cater to learners of all ages, which makes the perfect tool for parents and educators.

-

Accessibility: You have instant access numerous designs and templates saves time and effort.

Where to Find more Can You Pay An Employee 1099 And W2

Can An Employee Receive A 1099 And W2 ShiftPixy

Can An Employee Receive A 1099 And W2 ShiftPixy

You also do not have to withhold or pay employment taxes for 1099 workers In contrast W2 employees are more expensive You must adhere to minimum

Oct 11 2021 While the common assumption is that workers are either 1099 independent contractors or W2 employees The question can you have a 1099 and W2 from the

In the event that we've stirred your interest in printables for free Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Can You Pay An Employee 1099 And W2 for all needs.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning tools.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- The blogs are a vast spectrum of interests, from DIY projects to party planning.

Maximizing Can You Pay An Employee 1099 And W2

Here are some ways in order to maximize the use of Can You Pay An Employee 1099 And W2:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Can You Pay An Employee 1099 And W2 are an abundance of practical and innovative resources designed to meet a range of needs and interest. Their access and versatility makes them a great addition to your professional and personal life. Explore the vast array of Can You Pay An Employee 1099 And W2 to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can download and print these documents for free.

-

Does it allow me to use free printables for commercial uses?

- It is contingent on the specific terms of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may come with restrictions on use. Check the terms and condition of use as provided by the designer.

-

How do I print Can You Pay An Employee 1099 And W2?

- You can print them at home with your printer or visit the local print shop for top quality prints.

-

What program must I use to open printables free of charge?

- Many printables are offered in the format of PDF, which can be opened with free programs like Adobe Reader.

What Is 1099 Vs W 2 Employee Napkin Finance Has Your Answer

1099 Or W2 Finally Decide With Complete Confidence

Check more sample of Can You Pay An Employee 1099 And W2 below

1099 Vs W2 Difference Between Independent Contractors Employees

1099 Vs W 2 What s The Difference

1099 Vs W 2 What s The Difference QuickBooks

Form 1099 Vs W 2 For Workers What You Need To Know

The Difference Between A W2 Vs 1099 Employee YouTube

1099 Vs W 2 What s The Difference QuickBooks

https://kahnlitwin.com/blogs/tax-blog/can-an...

First off what s the difference between a 1099 and W 2 Form W 2 is used to report annual wages earned by an employee and any withholdings from income

https://www.deel.com/blog/issue-w-2-and-1099-to-the-same-person

Can one person receive both W 2 and 1099 forms Yes they can It s possible that an individual is employed at a company but still performs work as an

First off what s the difference between a 1099 and W 2 Form W 2 is used to report annual wages earned by an employee and any withholdings from income

Can one person receive both W 2 and 1099 forms Yes they can It s possible that an individual is employed at a company but still performs work as an

Form 1099 Vs W 2 For Workers What You Need To Know

1099 Vs W 2 What s The Difference

The Difference Between A W2 Vs 1099 Employee YouTube

1099 Vs W 2 What s The Difference QuickBooks

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

1099 Vs W2 Which Is Better For Employee Mind The Tax

1099 Vs W2 Which Is Better For Employee Mind The Tax

1099 Independent Contractor V W 2 Employee Avoid This Costly Employer