In the age of digital, where screens dominate our lives however, the attraction of tangible printed items hasn't gone away. Whether it's for educational purposes as well as creative projects or simply to add some personal flair to your home, printables for free are now an essential source. Through this post, we'll take a dive to the depths of "80g Donation Details," exploring the benefits of them, where they are available, and the ways that they can benefit different aspects of your life.

Get Latest 80g Donation Details Below

80g Donation Details

80g Donation Details -

Summary Section 80G of the Income Tax Act offers tax benefits for donations made to specific funds charitable institutions or trusts Taxpayers eligible to claim these deductions include individuals firms LLPs companies HUFs NRIs and others but only those opting for the old tax regime

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section 80G can be claimed on the amount donated to eligible institutions or funds

Printables for free cover a broad range of downloadable, printable materials available online at no cost. They come in many kinds, including worksheets templates, coloring pages and more. The benefit of 80g Donation Details lies in their versatility and accessibility.

More of 80g Donation Details

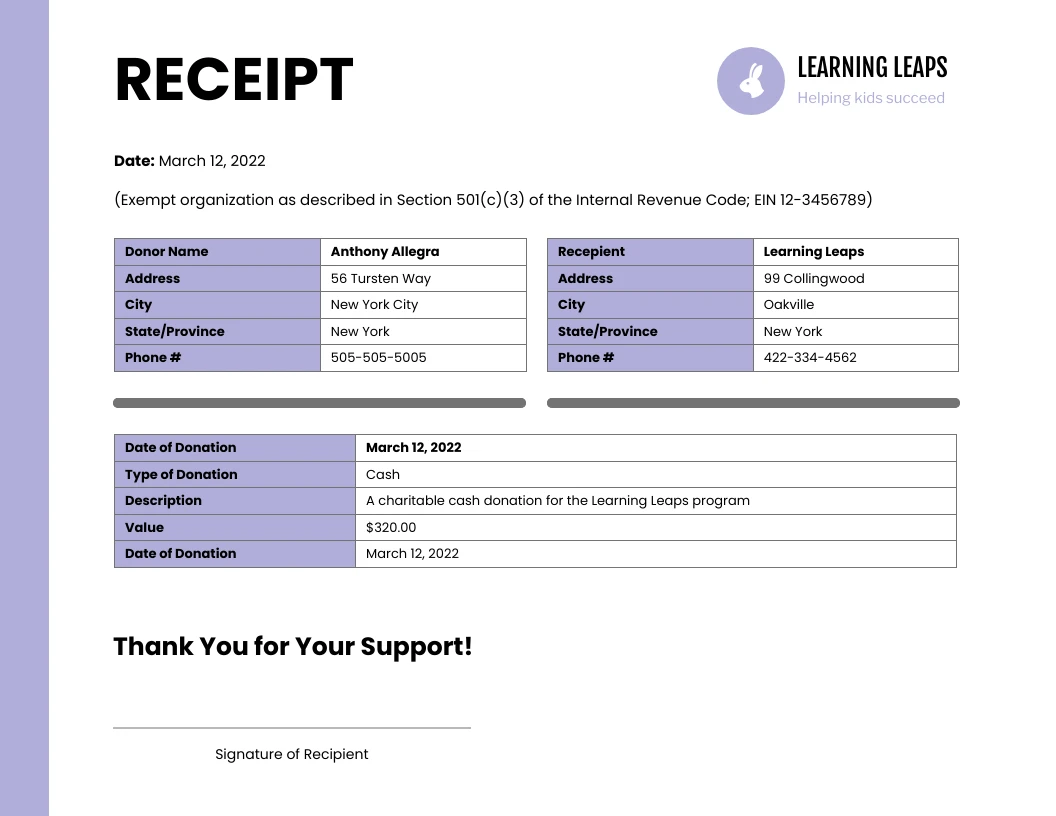

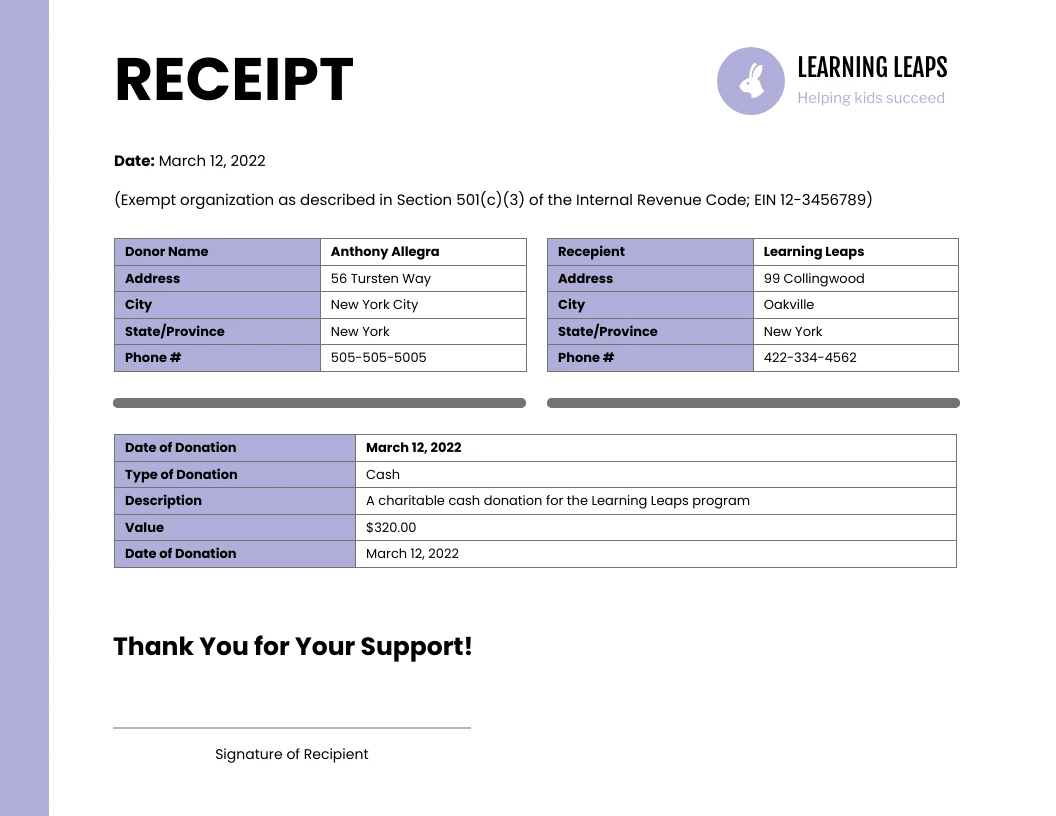

Nonprofit Donation Receipt Letter Venngage

Nonprofit Donation Receipt Letter Venngage

Section 80G Allows deductions on donations to specified charitable institutions offering up to 100 deduction depending on the fund It provides taxpayers relief through prescribed modes of payment such as cheques demand drafts or cash below 2 000

As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions to arrive at your taxable income In this article we will tell you how and when to claim deductions on donations made to Charitable Trusts and NGOs and how the tax laws are applied on the trusts conducting charitable religious

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: They can make designs to suit your personal needs whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Value: Education-related printables at no charge are designed to appeal to students of all ages, which makes them a valuable tool for parents and teachers.

-

Simple: immediate access numerous designs and templates saves time and effort.

Where to Find more 80g Donation Details

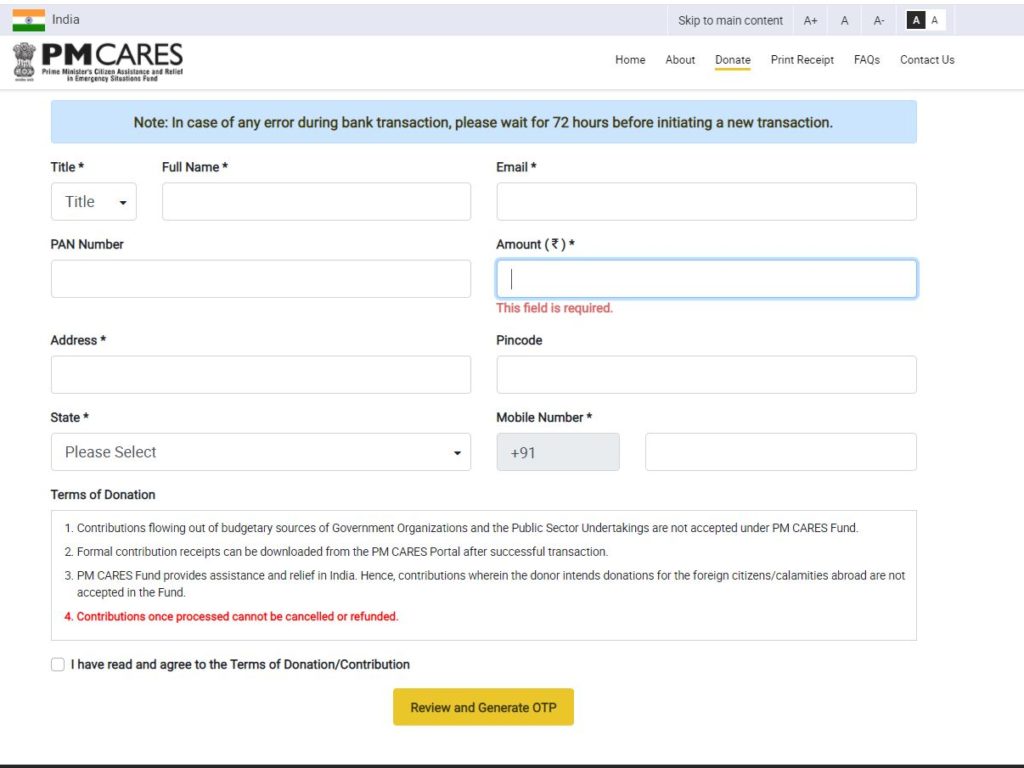

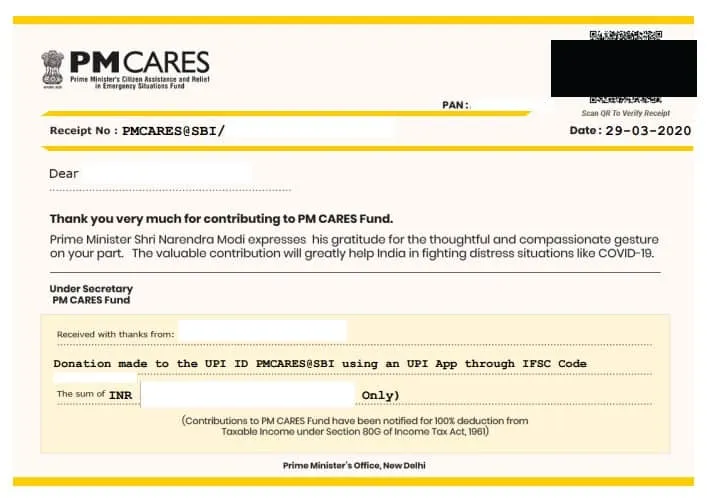

Pm Cares Fund Address Details For 80g GST Guntur

Pm Cares Fund Address Details For 80g GST Guntur

What is Section 80G Contributions to relief funds and humanitarian organizations can be deducted under Section 80G of the Internal Revenue Code Any taxpayer whether a person a corporation a partnership or another entity may claim this deduction Section 80G does not apply to all donations

Discover how to deduct donations to particular charity or organisations Deduct the amount from your taxed income under Part 80G of the Income Tax Act

We've now piqued your interest in 80g Donation Details we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with 80g Donation Details for all goals.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a broad selection of subjects, all the way from DIY projects to party planning.

Maximizing 80g Donation Details

Here are some ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

80g Donation Details are an abundance of innovative and useful resources for a variety of needs and pursuits. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the endless world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can download and print these tools for free.

-

Does it allow me to use free printables for commercial purposes?

- It is contingent on the specific rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables might have limitations on their use. Always read the terms and conditions provided by the author.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in an in-store print shop to get more high-quality prints.

-

What software is required to open printables free of charge?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software like Adobe Reader.

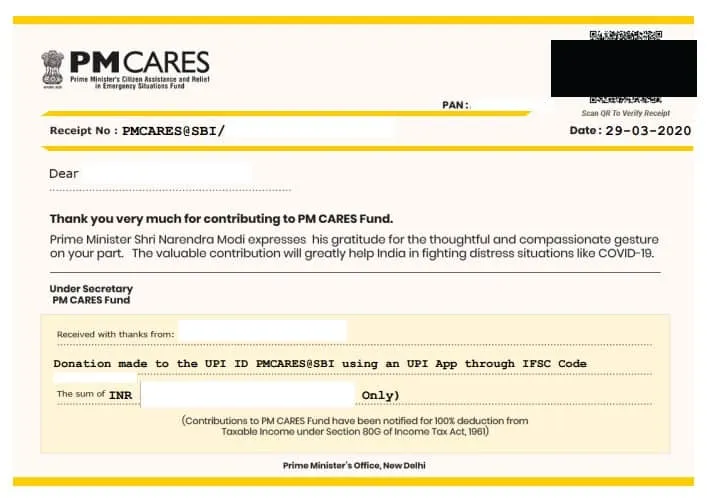

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Give A Donation Craigieburn Trails

Check more sample of 80g Donation Details below

Section 80G Deduction For Donation To Charitable Organizations

Donations Under Section 80G Deductions In Income Tax Teachoo

Donation Apps An Easy Way To Collect Donations

Configure 80G Enabled Payment Pages Receipt Configure 80G Enabled

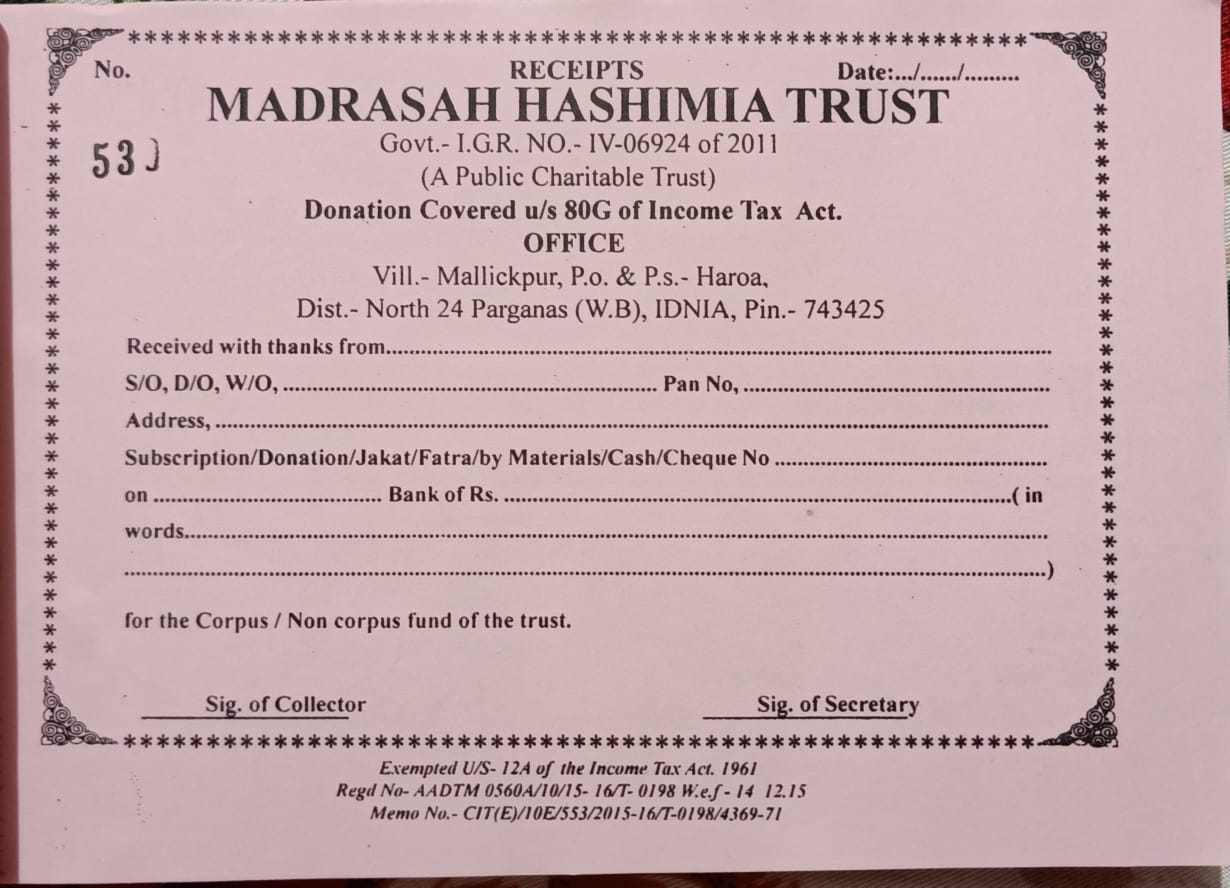

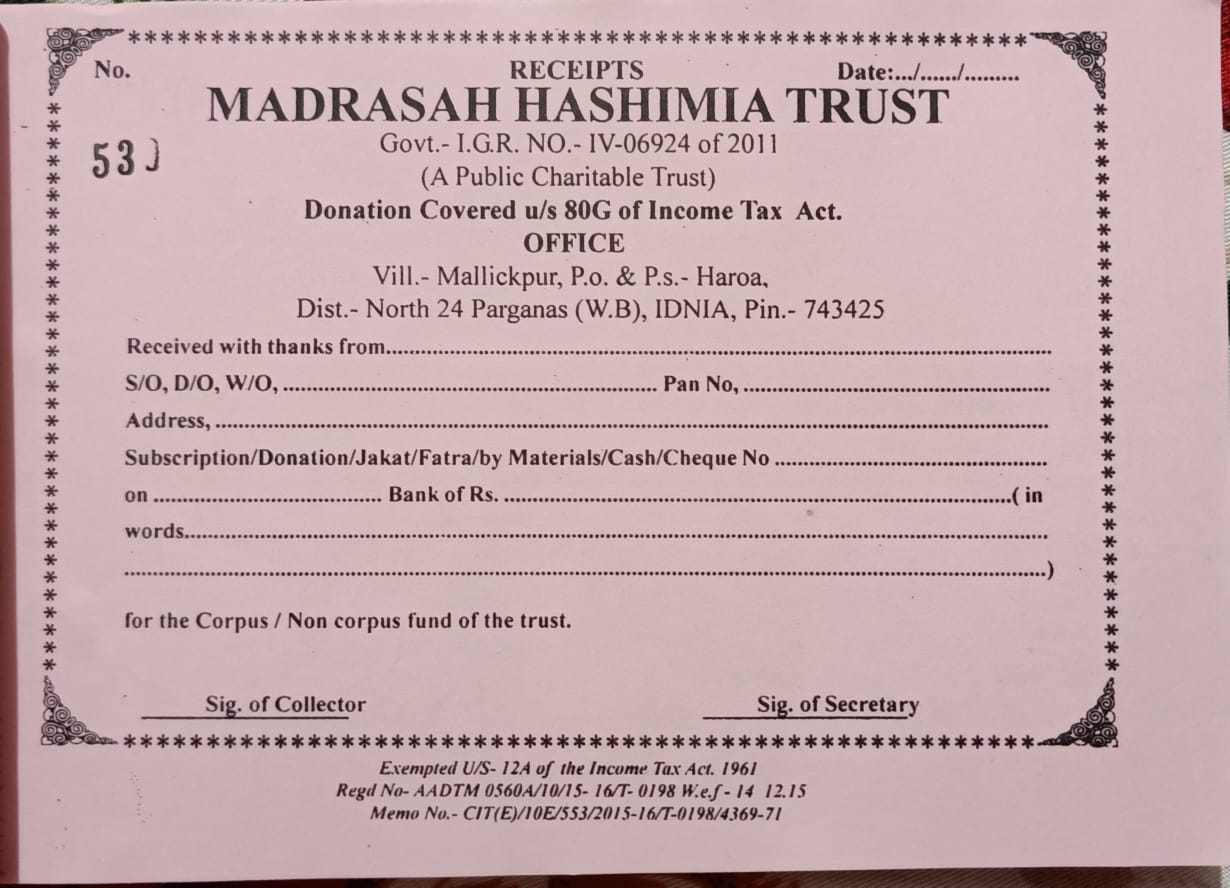

Donation Receipt Madrasah Hashimia Trust

How To Download Receipts Of Donations Made To PM CARES Fund To Avail

https://tax2win.in/guide/80g-deduction-donations...

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section 80G can be claimed on the amount donated to eligible institutions or funds

https://taxguru.in/income-tax/all-about-deduction...

Donations to the following are eligible for 50 deduction under section 80G subject to 10 of adjusted gross total income 1 Donation to the Government or any local authority to be utilized by them for any charitable purposes other than the purpose of promoting family planning

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section 80G can be claimed on the amount donated to eligible institutions or funds

Donations to the following are eligible for 50 deduction under section 80G subject to 10 of adjusted gross total income 1 Donation to the Government or any local authority to be utilized by them for any charitable purposes other than the purpose of promoting family planning

Configure 80G Enabled Payment Pages Receipt Configure 80G Enabled

Donations Under Section 80G Deductions In Income Tax Teachoo

Donation Receipt Madrasah Hashimia Trust

How To Download Receipts Of Donations Made To PM CARES Fund To Avail

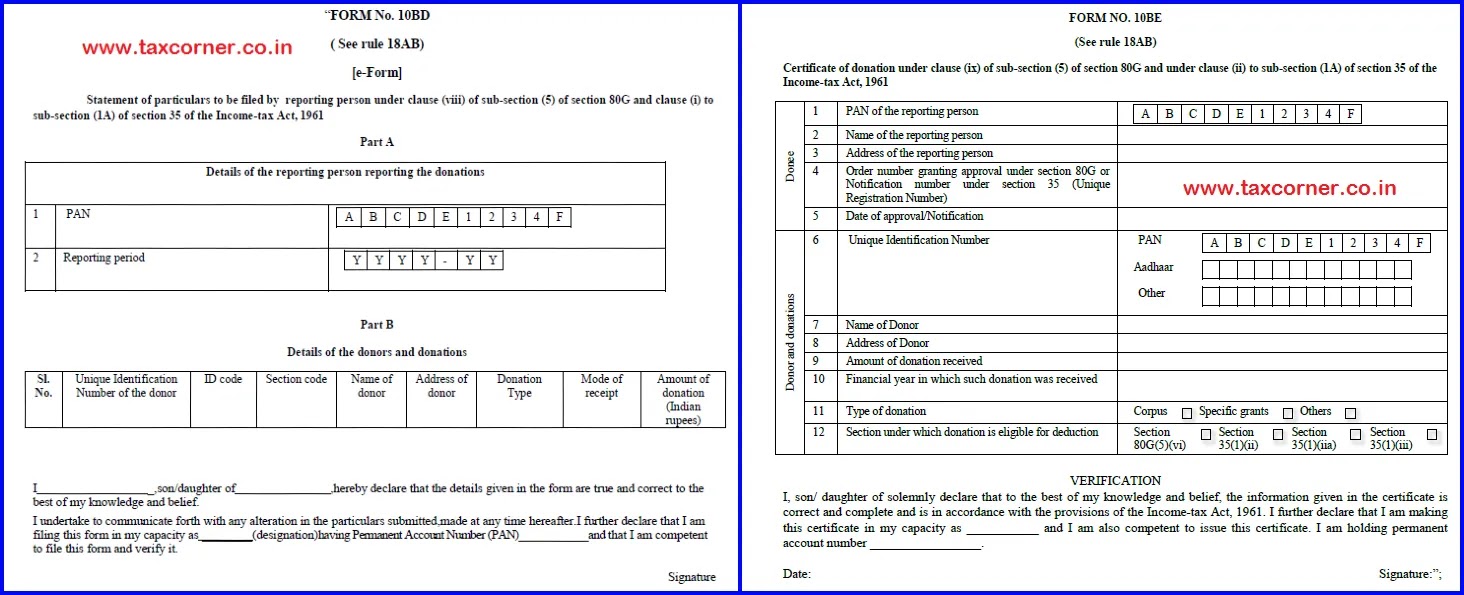

Procedure For Getting Certificate Of Donation FORM 10BE Online

Deduction Under Section 80G Of Income Tax Act 1961 For Donation

Deduction Under Section 80G Of Income Tax Act 1961 For Donation

Needed File Online Form No 10BD For Donations Eligible 80G